DAIM Issue 19 - Pulse Of The Market

Welcome to DAIM's Newsletter. DAIM is a licensed Registered Investment Advisor and asset manager for digital and traditional assets. Please enjoy our thoughts below. #Bitcoin

February 1, 2023

Bitcoin Up 15%+

Investor Sentiment

Hash Rate

DAIM: Unlike Any Other Business

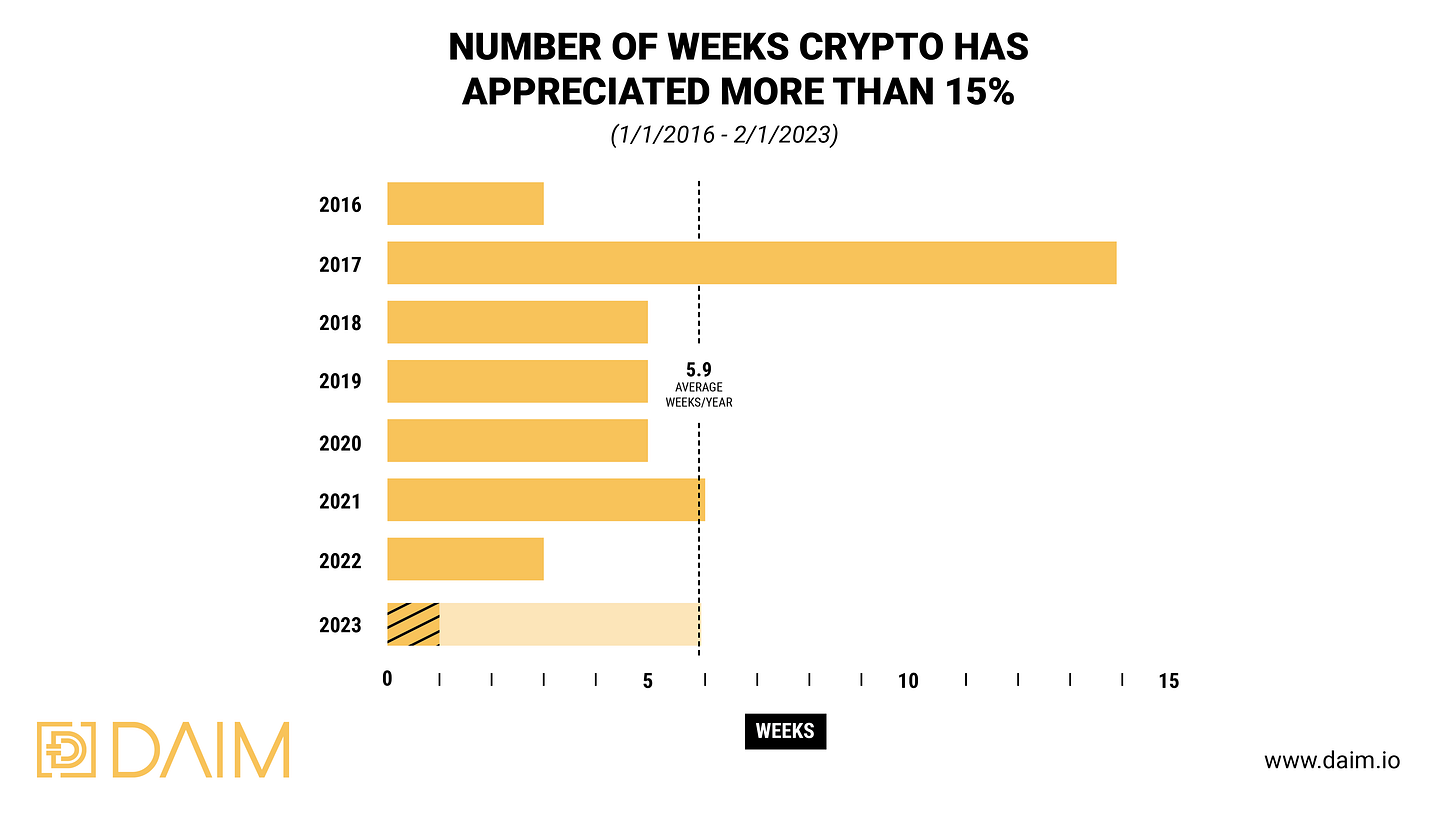

Bitcoin Up 15%+ - One metric that we like to track at DAIM is how often Bitcoin appreciates 15%+ over a seven day period. It’s something that TradFi investors rarely experience but for Digital Asset investors these weeks are a fairly common occurrence. In fact from 2017 through 2021 Bitcoin experienced at least 5 of these such weeks every year and averaged more than 6. In 2022 there were only 3 weeks that generated these outsized returns with the last occurring in July. So you could say that we were overdue for the recent rally that saw us catapult from about $17k to $23k in January. While history doesn’t necessarily repeat, we think that given where we are in terms of price and halving cycle, it is not unreasonable to expect even more big weeks ahead.

Investor Sentiment - Despite all the doom and gloom that mainstream media likes to pump out, if you look at the crypto landscape you’ll see things are trending up. To start the year we have noticed our conversations with clients and those looking to allocate are refreshingly upbeat. The fallout from FTX, Celsius, Genesis, et al. seems to have run its course and is solely in the hands of the legal system now. We don’t see any new developments affecting sentiment or price. With the negative surprises out of the way Digital Assets were primed to rally. And that is exactly what they did in January, ending the month up 40%. History has shown that investors consistently get the mechanics of buy low, sell high backwards. But we think that, in crypto, more people are recognizing that this is in fact an attractive entry point. If we are right and inflows dominate outflows, then the downside risk is minimal and the opportunity to grow and compound risk is immense.

Hash Rate - You might look at a price chart for Bitcoin and think that mining is becoming passe. Despite a decline in Bitcoin prices and mining rewards in the past year, the Bitcoin hash rate has increased more than 25%. In basic terms Hash Rate is a measure of the computer power being used to validate transactions. The higher the hash rate the more secure the network. So amidst hefty sell off the network continued to grow and became even more secure. This is great for long term adoption. The vast majority of negativity and adverse events in this space stem from bad actors at centralized exchanges. Their nefarious acts can slow Bitcoin temporarily but they can’t stop it from continuing on its long term path. Bitcoin will continue on as a decentralized autonomous entity. As more users see the benefit of the network more people will be incentivised to mine and secure it. Whether it be lightning network, merchant or government adoption, or even price appreciation people will continue to come to Bitcoin. And if what we experienced last year didn’t put a dent in hash rate then it is hard to imagine what could in the future.

DAIM: Unlike any other business. If someone wanted to invest in securities, finding an advisor could be overwhelming due to the abundance of choices. For Digital Asset investors the opposite is true. Almost no crypto firms provide investment advice and asset management by licensed professionals. What there is an abundance of is self-directed investment platforms. Some examples are Swan Bitcoin, iTrustCapital, Coinbase, Binance, and the infamous FTX. The individual will have to determine how much cash to allocate, move their own cash, decide what to buy, decide when to buy it, decide how to protect it, and figure out how to report it. In basic terms they accept your money and give you all of the investment risk. Some have high transaction costs and wide bid-ask price spreads that could be punitive. These providers may put out marketing that encourages frequent trading to capture more fees. The differences here are transactional based services vs value driven services. Our value comes in the form of protection, advice, and management.

DAIM manages digital assets for investors. We have rigid due diligence and review processes. We test investments with our own money before determining suitability for clients. This safeguard has protected us from doing any business with FTX and having assets impaired by Genesis. We took the initiative to use cold storage for added protection when Gemini’s legal situation seemed murky.

As part of our service we manage clients assets according to a strategically allocated portfolio of Digital Assets. If you wanted access to an actively managed crypto portfolio, you would typically need to invest through a crypto Hedge Fund. These have incentive fees, long lockup periods, and are only available to accredited investors. That’s not how we do things at DAIM. We operate essentially as a traditional advisor that focuses on digital assets. We charge a flat fee, have no account minimums, and allow investors to access their money 24/7. Our proprietary model portfolio has a since inception total return of 318%. Bitcoin alone over the same period has returned 207%. In order to be able to strive for exceptional returns it requires discipline and sticking to a plan both for us as managers and our clients. As much as crypto may seem like instant mega millions, that’s not the case. It takes tireless due diligence to make sure we are putting ourselves and our clients on the path to success. Our ethos is not to be emotional investors. It can be hard for an asset with this much volatility but history and our track record have shown that when we stay committed to a long-term, low turnover strategy, our clients are rewarded.

When the stomach is uneasy and prices near the lows it can be hard to be forward looking. But having the ability to stay the course and keep it simple, is what has rewarded successful investors throughout time. And this is why we are here, to help you stay the course and reap the rewards of investing in Digital Assets.

Over the next two months we would like to talk to each of you. Please email HQ@DAIM.io to schedule a time.

Thank you for being a client.