DAIM Issue 31 - What's in Store for 2024

Welcome to DAIM's Newsletter. DAIM is a licensed Registered Investment Advisor and asset manager for digital assets and bitcoin 401(k)s. Please enjoy our thoughts below. #Bitcoin #Ethereum #Solana

February 3, 2024

2023 was a bounce-back year for crypto. Will the momentum keep going in 2024? We think so. Here’s a quick look at what developments we have our eye on as the year progresses.

ETF

Price Target

Bitcoin Miners

Model Portfolio

Podcast Recommendation

ETFs - The primary downward pressure seemed to be from investors exiting GBTC after playing the discount arb. Through the first 8 trading days outflows exceeded $4B which dwarfed inflows into other spot ETFs. It seems the worst is over. The biggest threat to GBTC going forward is their 1.5% management fee which is considerably more than the average of the other 9 ETFs at about 0.25%. We think that if investors do redeem GBTC going forward it will be to rotate into the cheaper alternative. Therefore the net effect would be negligible and would not create downward price pressure on the underlying bitcoin. At the end of the year, we still think GBTC will have the most AUM simply due to its considerable head start. When Spot EFTs launched on Jan 16th all of the new offerings had to start at $0 in AUM (assets under management) whereas GBTC got to retain its holdings (about $26B in bitcoin) and saw its trust certificates uplisted to an ETF. It will take a while for that lead to disappear. In the meantime, inflows into other spot ETFs should pick up and sustained net inflows should push us to new all-time highs by year-end.

Price Target - As we said above we think we are headed to all-time highs by year-end. Inflows into spot products should become consistently positive. Consistent inflows coupled with the upcoming halving could create a unique dynamic not previously seen in prior cycles. With Institutional players providing spot EFT products to the masses, buying bitcoin has become much more streamlined and palatable to millions of retail investors. At the beginning of 2023, we felt that bitcoin could get $48k by year-end. We were a couple of weeks off. We also felt that post-halving could propel bitcoin to $130,500 by 2025. We think that the halving plus increased ETF demand could easily get us there. And remember that when bitcoin goes on a run in bull markets it brings the more volatile alts with it. So a 3x in BTC could easily mean a 3-4x or more for Ethereum, Solana, and others.

Bitcoin Miners - A key component of past post-halving rallies has been selling pressure from miners. Since miner’s income is generated from bitcoin block rewards and transaction fees the halving of the block reward will therefore reduce their mining income, all else equal. If miners have received less bitcoin, they will subsequently have less bitcoin to sell on exchanges. This has been the supply/demand dynamic that catalyzes the late-cycle rallies. The next halving will take the block reward to 3.125 bitcoin. Given new ETF inflows that will be occurring as these products gather AUM, selling pressure from miners dumping the block reward should have a minimal impact on price. Miners were selling aggressively in the last month of 2023 and the price continued to rise. The math post halving shows just how small the mining block reward is compared to daily trading value. Post halving the reward will be 3.125 BTC. A new block is produced every ten minutes, so 450 bitcoins are awarded every day. The average daily volume is about 500,000 BTC as of 2/1/24. Even if all of the bitcoin reward was sold daily it would only account for about .1% of daily trading volume.

It’s possible that transaction fees could drastically increase and create selling pressure if miners needed the liquidity. But as you can see transaction fees have predominantly been a small part of miner income. Ordinals have led to instances where transaction fees exceeded the reward but it would need to happen on a much more elevated and consistent basis to create material selling pressure. We think transaction fees would need to consistently be 4x the post-halving block reward to create that kind of pressure.

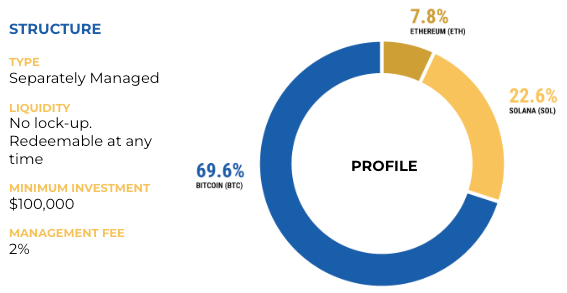

Model Portfolio - Our model portfolio is approaching 6 years since its inception. Throughout that time we’ve guided clients through 2 bear markets, generating alpha and stacking sats. In October we added a position in Solana and feel well-positioned for a post-halving rally. Details on the model portfolio are below. For those interested in allocating to the model portfolio email us at hq@daim.io

Podcast Recommendation - Bryan’s pick for a fun and informative podcast is E160 of the All-In Podcast. There is some great banter on what investing themes played out in 2023 and what might be a winner in 2024. They even weigh in on bitcoin. Check it out!