DAIM Issue 32

Welcome to DAIM's Newsletter. DAIM is a licensed Registered Investment Advisor and asset manager for digital assets and bitcoin 401(k)s. Please enjoy our thoughts below. #Bitcoin #Ethereum #Solana

Forecast

Bitcoin is the New Gold

Two’s Company

Forecast - The Bitcoin halving is on schedule for April 19th. With it only a few weeks away we don’t anticipate any drastic price action. Bitcoin just ripped more than 15% in the last week. While it could keep the momentum going into the next weeks, we think that all-time highs will come after the halving, not before it. We’re sticking to our year-end target of $130,500 so even if you think we are due for a pullback, getting long now is a plan we think will reap benefits regardless.

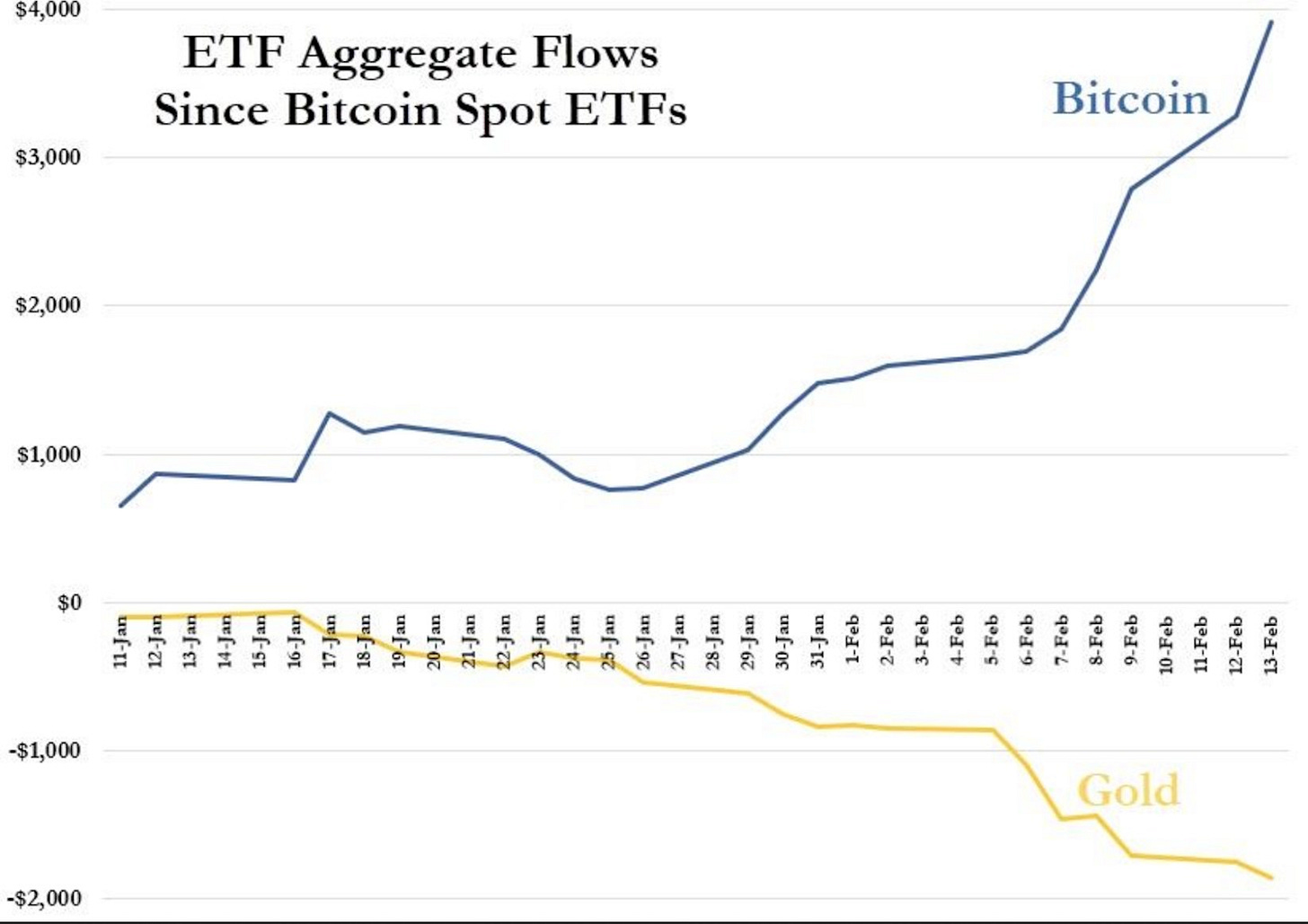

Bitcoin is the New Gold - This is simple. Money is flowing out of Gold and into bitcoin. Take a look at the stark contrast in ETF fund flows, courtesy of Jameson Lopp.

Gold has long been touted as an inflation hedge and flight to safety for a weakening dollar. Its reputation as the premier hard asset no longer holds. Bitcoin is scarcer, more durable, more portable, more divisible, and immutable. If someone gave you gold could you tell if it was counterfeit? Now take bitcoin. If you had a bitcoin wallet you would know definitively if someone sent you legitimate bitcoin. We think that bitcoin is a superior hard asset. It has been a better investment in its short history and we think it will be a better investment in the long run. Warren Buffet in his 1987 Berkshire letter to shareholders quoted Ben Graham, writing "In the short run, the market is a voting machine but in the long run it is a weighing machine." The early votes are in and bitcoin is winning. Will it outweigh the competition in the long term? We think so.

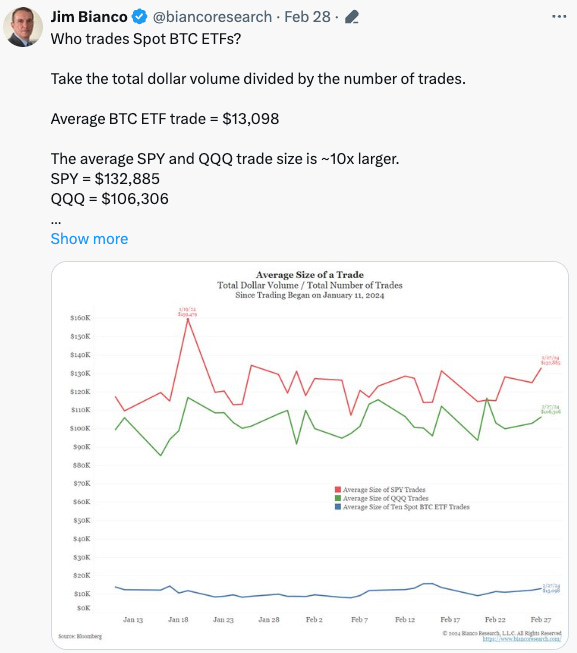

Spot Bitcoin ETFs have a ways to go to outweigh their gold counterparts. If bitcoin’s market cap was to reach gold’s, ~$13 Trillion, that would be a per bitcoin price of about $650,000. If flows are an early indication of a continued trend then that passing of the torch could happen in this decade. Look at the tweet from Jim Bianco below. Bitcoin is experiencing staggering inflows on relatively small trade sizes. That could be in part due to retail still being largely gated from buying the ETF. Vanguard, JPMorgan, Edward Jones, and more don’t allow retail clients to buy these products on their platforms. These brokerage houses are going to end up folding and eventually allowing their clients to invest in bitcoin ETFs because they don’t want to give up market share.

Vanguard’s CEO even stepped down recently, which may not be a coincidence. Regardless once they reverse course, even more liquidity will be unlocked and we could see a parabolic move in bitcoin’s marketcap.

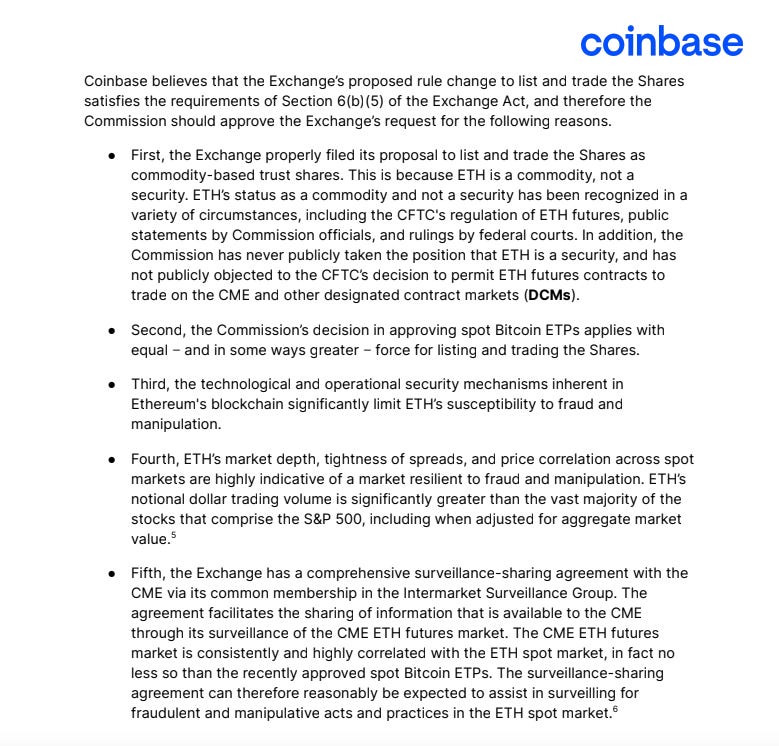

Two’s Company? The Bitcoin ETF is here. Will the Ethereum spot ETF be quick to follow? Probably not. Some proponents thought an approval would come as soon as March. We think that the ETF is coming but not until late 2024 or early 2025. Gary Gensler and the SEC dragged their feet on the Bitcoin spot ETF and they feel they have a little more ammo with respect to Ethereum. Bitcoin was always recognized as a commodity, whereas Ethereum has some distinct features that some regulators could construe as more like a security. It had an ICO, similar to a traditional IPO, it’s Proof of Stake consensus mechanism pays out rewards to stakers that is similar to a company paying dividends. And it has a figurehead, Vitalik Buterin, who resembles a CEO. The SEC could continue to argue these aspects and delay the filing, but we think the Ethereum ETF is coming. It’s hard to argue for investor protection and against the Ethereum ETF when there are leveraged single-stock ETFs. Do you think an investor is safe using a 2x product like TSLR to buy shares of a stock like Tesla, whose enigmatic CEO could sabotage shareholders on a whim? It should be up to investors to determine if the risk of an investment is worth the reward and a spot Ethereum ETF is no riskier than countless investments that retail investors have access to in their brokerage accounts. Coinbase recently put out a 27-page report arguing for Grayscale’s trust shares (ETHE) to be uplisted to an ETF. You can read the entire report here. On page three it summarizes its case which you can see below. The points are compelling which is why we think the ETF is inevitable just not imminent.