DAIM Issue 35

Welcome to DAIM's Newsletter. DAIM is a licensed Registered Investment Advisor and asset manager for digital assets and bitcoin 401(k)s. Please enjoy our thoughts below. #Bitcoin #Ethereum #Solana

Forecast

15% week

ETH spot ETF

Addresses in Profit

DAIM Insights - The Devaluing Dollar

Forecast - Non-bitcoin headlines were prominent in May. Ethereum had a somewhat surprising spot ETF approval; more on that later. Meme coins drove the price action, especially with their proliferation on Solana. Every day, a new meme coin seems to do a 10x on Solana. But for every person who captures that outperformance, 1000 people lose significant capital. It’s a digital casino. Therefore, we recommend resisting the urge to dive into any meme coin that catches your attention.

Bitcoin price action was ho-hum in May. As we’ve mentioned before, while the halving is a catalyst for medium to long-term outperformance, the immediate months that succeed the halving have historically been uninspiring. To illustrate check out the chart below from the All-in Podcast. (There is a good discussion on the halving and price performance that begins at 55:00).

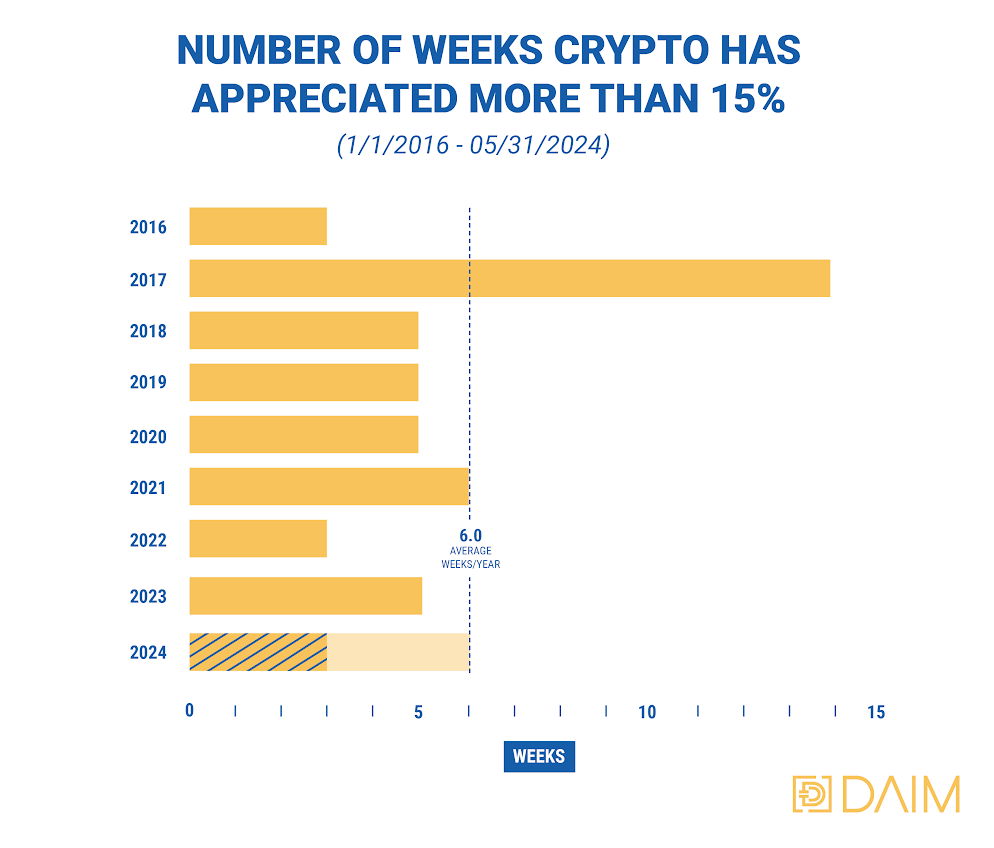

As you can see from past cycles, it takes about 9 months for bitcoin to take off post-halving. While we are in general agreement with the data, know that now there are more avenues for institutional players to front-run retail and push the price up sooner. We advise deploying capital earlier if possible and using the summer months to allocate any dry powder.15% week - Another month, another week where bitcoin appreciated at least 15% in a week. So far, we are up to three 15% weeks in the first 5 months. This keeps us on track for 6 total weeks in 2024. We averaged that for the last 8 years, and we seem to be keeping pace so far. We mentioned that the summer has historically seen bitcoin move sideways, but given that the last quarter of these halving years have been where previous bull runs took off, we think 3 more of these weeks is a real possibility. And remember, don’t try to time this market. If you have cash you want to allocate and have a long-term investing horizon, you can never be too early. Get your money invested, and let these assets do the work for you.

ETH spot ETF - While we always thought there would be a spot ETH ETF, we were surprised that their approval came this early. It looked like these products wouldn’t be available until late 2024, but now they will begin trading in the next month or two. The next step is for spot ETF issuers to submit S-1 forms to register the products with the SEC. This is a formality, and we should see the ETH ETF soon.

While this is good news for traditional investors, what does it mean for us crypto native hodlers? We think that this is a positive development. Inflows into these products should be significant. Spot bitcoin ETFs have seen about $13.6B in net inflows. If you exclude the Grayscale’s GBTC outflows, this number increases dramatically to over $30B. Grayscale's Grayscale Ethereum Trust (ETHE) product currently has a market cap of about $8.59B, so the demand for these products is there. As money flows into these ETFs, issuers must buy more ETH to back the shares. This will lead to more network activity and, given Ethereum's current issuing dynamics, could lead to new burning and a deflationary supply. Framing it in a traditional finance sense, this would be like a stock buyback, which has generally led to even more share price appreciation during a bull market.

While TradFi will benefit from this offering, crypto-native investors will maintain a distinct advantage over their counterparts who hold the derivative. Native ETH can be staked, earning holders an additional annual yield of around 3.5%. Issuing firms amended their ETH offerings to exclude staking because they fear that the SEC will view staked ETH as a security, with the staking rewards representing dividends. So, ETH ETF holders will miss out on the additional staking yield that our clients and all native ETH holders can earn. Also, an ETH ETF is a security, whereas native ETH is not. That means wash rules still do not apply to native Ethereum, making it a much more efficient investment from a tax perspective. Additionally, spot Ethereum can be transacted 24/7, whereas ETFs can only be bought or sold during relatively limited traditional market hours. Another advantage glossed over is that any airdrops are automatically credited to ETH holders with an actual ETH address. This was a benefit to ETH holders in previous cycles and will not be available to ETF holders.Finally, because the ETH ETF has been approved, don’t expect the floodgates to open to other coins. The SEC has generally been one of the slowest and most reactive regulatory bodies. For example, Bitcoin and Ethereum futures began trading in 2017 and 2021, respectively. This paved the way for spot ETFs to be offered. Currently, BTC and ETH are still the only crypto futures contracts offered by the CME. Since the SEC tends to follow, not lead, we don’t see a spot Solana ETF until Solana futures are available to TradFi investors. And if a Solana ETF is a long way away, so are DOGE, PEPE, MATIC, XRP, and other crypto ETF offerings. If you want to take advantage of a post-halving crypto bull run, keep your money in the real thing, not an ETF.

Addresses in Profit—As we enter the exciting part of the Bitcoin cycle, we need to have a clear plan to take profits when needed and maximize our chances of achieving our long-term investment goals. In a volatile crypto market, knowing when we may reach cycle peaks is important. Obviously, we can’t know the future, but we can use metrics and past patterns to try and make the most informed decisions possible.

One important metric we consider is Addresses in Profit. Addresses in Profit is the percentage of wallet addresses showing a profit. Addresses in Profit is simply the proportion of distinct addresses holding bitcoin where the average purchase price is beneath the current market value. Take a look at the last 10 years below.

We’re currently at around 95% of addresses in profit. During the peak of the past bull runs, more than 99% of all addresses have been in profit for a prolonged period. This makes sense since these periods coincided with bitcoin regularly reaching new all-time highs. Since bitcoin is digitally scarce and has a diminishing supply schedule, long-term holders will naturally dominate over time. But this metric can still be instructive. We think monitoring how long it stays above 99% will be something to keep in mind this cycle.DAIM Insights - We dedicate a section of our website to introductory crypto topics and investment cases. One topic that keeps coming up is the Devaluing of the Dollar. We recently covered the devaluation and how digital assets can be used to combat it. Read the full post here. If you know someone looking for reasons why they should invest in crypto, this is a great page to share with them.