DAIM Issue 37

Welcome to DAIM's Newsletter. DAIM is a licensed Registered Investment Advisor and asset manager for digital assets and bitcoin 401(k)s. Please enjoy our thoughts below.

Forecast

Dollar Debasement

Pensions Embracing Bitcoin

Sayloring Away

In The News

Forecast - Bitcoin tested the mid-50s before rallying on the Donald Trump assassination attempt. For a moment, the prospect of a Republican (and more pro-crypto) presidency was attracting buyers. Going forward, we think crypto will become a bipartisan issue that both parties will embrace. In addition, we have the ETH spot ETF officially trading. Initial trading indicates downward pressure on ETH as holders unload the expensive Grayscale ETHE ETF. As we saw with GBTC, this selling pressure could persist for a few weeks. We’re confident things will turn around, and we still anticipate a turnaround in late August, which is just in time for FTX claimants to receive their cash settlements.

In the past, we have publicly shared our price projections and insights on Bitcoin's market cycles. Recognizing the immense value of this information, we will now provide it exclusively to our active clients. Our Model Portfolio work is dedicated to their benefit. We are always available for one-on-one discussions about forecasts and our strategies.

Dollar Debasement - If you’ve been around cryptocurrencies for a while, you’ve probably heard the term debasement, usually in the context of the debasement of the US dollar. But what exactly does it mean? Debasement is the process of reducing the quality or value of something, implicitly or explicitly. Bitcoin Magazine recently published an in-depth article that we will help summarize here.

What is Dollar Debasement? It is the act of reducing the value of something. This can be done in obvious and subtle ways. An obvious way would be to reduce the valuable components of money. For example, a government issues gold coins that are 100% pure. Later on they introduce new gold coins that are 50% cheap metal and 50% gold. The value of that coin has been debased by 50%. For a modern example, look at the Bretton Woods system. Bretton Woods required countries to guarantee the conversion of their currency into gold bullion. This tethering of fiat to gold was meant to keep governments in check and help prevent the excess money printing that could lead to runaway inflation. The government couldn't just print new fiat because they would have to go out and find an equivalent amount of gold, which is difficult to do. This system did not last long in a historical sense, having been in effect from 1944-1971. Since then, inflation has reduced the value of the US dollar by about 85%, and the money supply has increased by 30x. In the same time period, the US population has increased by 60%.

How does the US debase the Dollar - Getting rid of the gold standard was the big kickstart to monetary debasement. However, the US has other means to achieve this. Two primary ones that get a lot of attention these days are money printing and interest rates. Money printing being the obvious one. During covid, a lot of stimulus was injected into the US market. This had two effects. It made the value of existing dollars less since there were now more of those exact same dollars in circulation, and it increased the prices of assets through inflation. Inflation happened because people wanted to spend their money instead of hold it and watch it lose value. This increase in spending leads to an increase in demand for assets. Since the assets could not be reproduced with the ease that dollars could, you had a large amount of money chasing a much smaller amount of goods. So prices got bid up or inflated, and things became more unaffordable for subsequent buyers. The other way the dollar gets debased is through low interest rates. Low interest rates spur borrowing and credit creation. Borrowing again allows people to have more money to chase that scarce good which over time increases the price of goods and leads to inflation. It’s worth noting that governments favor these methods because the main alternative is to raise taxes. Raising taxes is an implicit cost that individuals feel every time they spend or get paid. So this implicit taxation through monetary debasement is preferred. But over time, the effects are just as harmful.

Why can't bitcoin be debased - So what makes bitcoin different from dollars? First, bitcoin cannot be inflated. The supply schedule is hard coded, culminating in a terminal supply of 21,000,000 in 2140. Until then, a set amount, currently 3.125, is released approximately every 10 minutes. This amount is cut in half every four years until we reach the 21,000,000 bitcoin threshold. Second, bitcoin is decentralized. Changes to the bitcoin code require the vast majority of the network to be in agreement. Contrast that to fiscal and monetary policy changes in the US, where a small minority make the rules for millions. Bitcoin is democratic, sound money.

Pensions Embracing Bitcoin - Institutions are starting to get the picture. 3 US pension funds have been orange-pilled this year. NJ, Michigan, Wisconsin. It looks like it’s a matter of time before bitcoin is truly accepted as a macro asset in public portfolios. Pensions are unique vehicles because they have what is known as a defined benefit that must be paid by employers to pension plan participants (employees). This benefit is generally based on years of service and salary around retirement time. That sets the benefit to be paid in retirement until the now-former employee passes away. This creates a dynamic called asset-liability matching (ALM). If an employer's assets cannot cover the pension benefits (liability), the plan can become underfunded, and employees could lose out on promised benefits. There are a lot of assumptions and variables at play here, but at a basic level, you are just trying to get the asset base to grow faster than the liabilities owed. One possible way to get your assets to grow faster is by investing in some bitcoin. It appears that public pensions are finally catching on.

Last Thursday, the Jersey City Pension Fund announced it will invest in Bitcoin ETFs.

In May, the state of Wisconsin Pension Fund announced it, too, owned Bitcoin ETFs to the tune of $163 million.

The State of Michigan Retirement System said it now owned $6.6 million in Bitcoin via ETFs.

It appears that times are changing. As more institutional players see bitcoin as a way to help their portfolio of assets meet a level of growth, it is sure to attract copycats and followers from those who have not adopted the strategy. This increase in demand could have an immensely positive impact on the future price of bitcoin.

Sayloring Away - Speaking of the future price of bitcoin, Michael Saylor took time at the Bitcoin 2024 Conference to lay out his 2045 prediction for the asset. His bull case? $49,000,000/bitcoin. His base case was toned down a little but still arrived at $13,000,000 in 2045. To arrive at these figures, he assumes an annual rate of return of 29% for the base case and 37% for the bull case. These rosy predictions are due to some very aggressive return assumptions. Since 2011, it has had a Compound Annual Growth Rate (CAGR) greater than 100%. Bitcoin’s growth was exponential in its early years, so proponents naturally think a long-term growth rate of only 20-40% is reasonable. However, the return assumption for even the bear case made by Saylor is 21% annually. Over the last 20 years, the NASDAQ and SP 500 have returned 14.5% and 13.6%, respectively. For the next 20 years, 20% may seem achievable. That growth rate would take bitcoin to $3,000,000 in 2045. Saylor’s base case was for bitcoin to be valued at 7% of all the world's assets. The bear case would put bitcoin at 1.6% of the world's assets, all else equal. While we appreciate Saylor’s enthusiasm for bitcoin, we think an annual return assumption of around 20% is more likely. This still handily beats traditional assets and is a sign that you, as an investor, are still early.

In The News - Our CEO Bryan Courchesne recently appeared on CNBC to discuss what Trump would say at Bitcoin 2024. Bryan was spot on, as Trump said he wanted to see bitcoin become a strategic asset for the US. See what Bryan shared below, how bitcoin could become a strategic reserve asset, and compare it to Trump’s speech at the conference.

How DAIM benefits clients

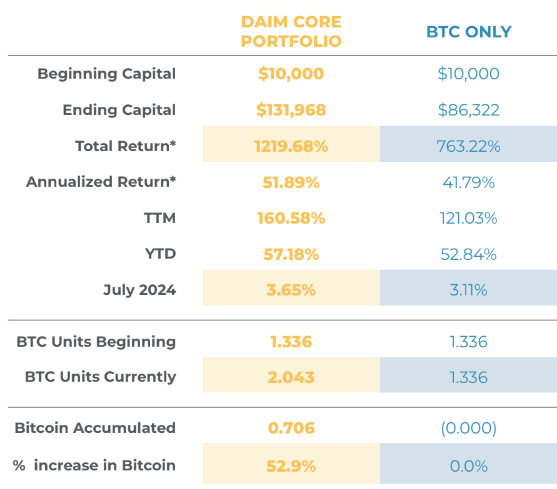

Model Portfolio: Our meticulously managed portfolio has consistently outperformed the simple strategy of buying and holding bitcoin alone by more than 456% since inception on 5/31/2018.

Wealth Management: As a licensed Registered Investment Advisor (RIA), we cater to clients with diverse financial needs, including Trust accounts, brokerage accounts, and IRAs. Our services encompass comprehensive tax strategies and audits to optimize your financial outcomes.

Tailored Solutions for Various Investors:

Individual Professionals: Busy individuals like doctors who lack the time to stay updated on market trends.

Altcoin Exposure in Retirement: Investors seeking exposure to alternative coins within their retirement accounts.

Intergenerational Wealth Planning: Large families aiming to create and manage intergenerational wealth, including gifting in bitcoin across multiple generations.

Simplified Management: For investors overwhelmed by the complexities of managing multiple wallets and decentralized exchanges (DEXes), and finding it challenging to track or rebalance their assets promptly.

Enhanced Support and Communication: We understand the frustrations of navigating communication with crypto exchanges. At DAIM, we provide easy access to expert guidance, ensuring seamless communication for our clients.