DAiM Issue 40

Welcome to DAIM's Newsletter. DAIM is a licensed Registered Investment Advisor and asset manager for digital assets and bitcoin 401(k)s. Please enjoy our thoughts below.

Overview

Elections

BTC at $100k

Microsoft

China

BlackRock

DAiM Performance

Overview - For much of the month, it looked like "Uptober" might be off. Bitcoin hovered in the low $60,000 range until a late-month jolt pushed it past $70,000. Whether this rally will hold remains to be seen, but it appears driven by the market pricing in a potential Trump win—and with it, a more favorable crypto environment. Polymarket currently shows Trump as a clear favorite, while polls suggest a tightly contested race. Regardless of the outcome, there are many positive catalysts and developments strengthening our conviction in a sustained long-term bull run.

Elections - As we mentioned, Polymarket and other prediction markets have been prominent players in this race, with current odds favoring Trump as the winner. Traditional polling, on the other hand, suggests a much closer contest, essentially a toss-up. Both approaches have limitations: prediction markets, for example, can be skewed by large bets on a particular candidate, while polls struggle with accurately sampling a representative voter base.

Regardless of the outcome, we don’t believe the election will have a lasting effect on crypto. An initial dip in crypto prices could follow a Harris win, or we could see a "buy the rumor, sell the news" effect if Trump wins. In the long term, though, adoption and prices should continue to rise. Since its inception, bitcoin has thrived in both indifferent and even hostile regulatory climates. Trump’s current stance on crypto is a stark contrast to his first term, when bitcoin rose from $1,000 to $40,000. Looking at the historical price chart spanning both parties, it’s clear that bitcoin doesn’t depend on government approval. This train isn’t stopping.

BTC at $100K - $100,000 bitcoin could be just around the corner. But does this number actually hold any real significance? Some people view this price point as a psychological cue to sell, but does $100,000 bitcoin fundamentally change things? Not really. While it’s certainly a meaningful milestone, we wouldn’t recommend selling a substantial portion just to lock in profits or try timing a buyback at a lower price. Although some will cash out at this historic level, plenty of new buyers and capital will be eager to claim their share of bitcoin’s limited supply. Adoption, whether by countries or companies, remains low, and we’ll touch on some examples later. From our perspective, $100,000 bitcoin isn’t an end goal; instead, it’s just one step in a larger trajectory. There’s a good chance that, in a decade, people will look back and wonder why they didn’t buy more when bitcoin was “only” $100,000.

Microsoft - The list of companies holding bitcoin on their balance sheets is growing, with notable names like MicroStrategy at the forefront. Through the use of cash, equity, and convertible notes, MicroStrategy has acquired 252,220 bitcoin, roughly 1.2% of the total supply. Tesla also holds bitcoin, albeit on a smaller scale, with 9,720 bitcoin. Tesla briefly accepted it as payment in 2021, but primarily, bitcoin-holding companies remain smaller firms or mining companies.

This trend may be evolving, however, as Microsoft recently announced that shareholders will soon vote on a proposal to hold bitcoin on its balance sheet. Although the board has recommended voting against the measure, there is a possibility it could pass. Microsoft would hold a relatively modest amount of bitcoin as an inflation hedge. Historically, companies with substantial cash reserves have been valued for their potential to drive growth through acquisitions, R&D, or shareholder returns. But in today’s inflationary environment, excess cash can also be a liability, reducing future earnings potential. By hedging with bitcoin, companies could offset this drag on growth—a strategy that may become more common over time. For instance, if Microsoft allocated just 1% of its cash reserves, that would translate to roughly $1 billion in bitcoin. As more S&P 500 companies adopt similar strategies, the increased demand for this limited asset would likely place significant upward pressure on bitcoin’s price.China - Rumors are circulating that China may issue 10 trillion yuan (about $1.4 trillion) in debt to stimulate its sluggish economy. The last time China expanded its money supply this dramatically was in 2015, which coincided with bitcoin rising from $135 to $600. Although China has generally restricted its citizens’ access to bitcoin, it’s impossible to ban it entirely. If wealthier Chinese citizens see their currency devaluing significantly, they’ll likely seek assets to help preserve their wealth—and there’s no asset better suited for that than bitcoin.

BlackRock - With record inflows into the iShares Bitcoin Trust ETF (IBIT), BlackRock now holds approximately 2% of the bitcoin supply. Although some institutions use the ETF primarily for trading, the massive inflows highlight traditional finance’s growing confidence in bitcoin. On October 29 alone, BlackRock saw $629 million in net inflows. These ETFs are positioning bitcoin for a substantial rally if the trend persists into the current post-halving cycle. As more people and institutions buy into ETFs, issuers like BlackRock are compelled to purchase bitcoin at spot prices. With more bitcoin moving off exchanges, the limited availability pushes spot prices higher as demand stays strong or continues to rise. We believe this trend will endure, making six-figure bitcoin a likely milestone in the near future.

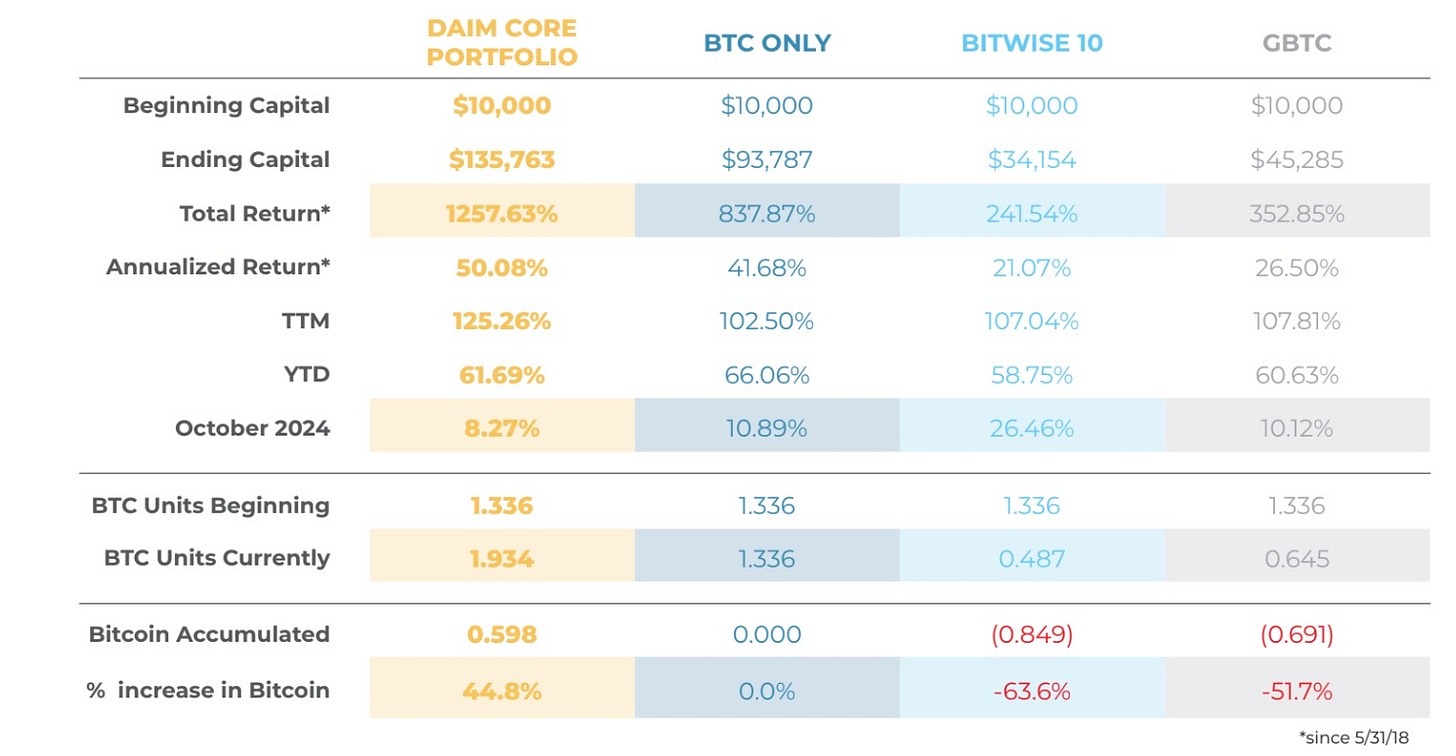

DAiM Performance

How DAiM benefits clients

Model Portfolio: Our meticulously managed portfolio has consistently outperformed the simple strategy of buying and holding bitcoin alone by more than 419% since inception on 5/31/2018.

Wealth Management: As a licensed Registered Investment Advisor (RIA), we cater to clients with diverse financial needs, including Trust accounts, brokerage accounts, and IRAs. Our services encompass comprehensive tax strategies and audits to optimize your financial outcomes.

Tailored Solutions for Various Investors:

Individual Professionals: Busy individuals like doctors who lack the time to stay updated on market trends.

Altcoin Exposure in Retirement: Investors seeking exposure to alternative coins within their retirement accounts.

Intergenerational Wealth Planning: Large families aiming to create and manage intergenerational wealth, including gifting in bitcoin across multiple generations.

Simplified Management: Investors overwhelmed by the complexities of managing multiple wallets and decentralized exchanges (DEXes), finding it challenging to track or rebalance their assets promptly.

Enhanced Support and Communication: We understand the frustrations of navigating communication with crypto exchanges. At DAIM, we provide easy access to expert guidance, ensuring seamless communication for our clients.

Curious to Learn More About Investing with DAIM? Contact us at hq@daim.io