DAiM Issue 41

Welcome to DAiM's Newsletter. DAiM is a Registered Investment Advisor focusing on Crypto Wealth Management and bitcoin 401(k)s. Please enjoy our thoughts below.

Overview

Satoshi Wallets

Long & Short of it

Don’t go at it alone

DAiM Performance

Overview - Bitcoin gave investors plenty to be thankful for in November. On November 5th, as a Trump presidency became a reality, bitcoin took off. By the close of November 6th, it had reached a new all-time high, setting the stage for an impressive rally throughout the month. While the price action was thrilling, the election also felt like a broader referendum on the future of finance—a future with limitless possibilities, and one we can truly be thankful for. For now, $99,500 marks the all-time high. But $100,000 is within reach, and soon we’ll be setting our sights on celebrating $1,000,000 bitcoin.

Satoshi Wallets - A recent article suggests that Satoshi may actually be alive and taking profits. The theory suggests that Satoshi distributed 50 BTC mining rewards (from 2010–2012) across numerous addresses. This strategy would allow for spending in a way that minimizes any impact on Bitcoin’s price, separate from the approximately 1 million BTC tied to 2009 addresses, which have never been sold.

While blockchain enthusiasts will continue analyzing transactions to uncover the mysterious creator, it’s important to recognize that bitcoin has matured beyond the influence of any single individual on its long-term price. Coins mined in 2010 that were sold over the years show no clear correlation with price movements 6 to 12 months later, based on our analysis of historical performance.

Although large holders, like MicroStrategy, could temporarily affect bitcoin’s price by selling substantial amounts, bitcoin has evolved to withstand such events without long-term damage. It’s entertaining to track these movements and craft theories, but ultimately, that’s all they are—just theories. Take them with a grain of salt and keep stacking sats!Long & Short of it - The beauty of bitcoin’s transparent public ledger lies in its ability to provide a real-time view of market activity. This transparency enables us to observe relationships and trends as they unfold.

One thing we like to look at is the dynamic between long-term and short-term bitcoin holders (LTHs and STHs), which plays a critical role in shaping market behavior. In simple terms, An LTH is a bitcoin address whose average holdings are older than 155 days. Any address that falls short of this 155-day mark is an STH. While we believe the metric should account for a longer holding period to reflect shifting market dynamics that have occurred over the last decade, 155 days remains an informative marker, especially at this stage in the post-halving bitcoin cycle. More here on Glassnode. A few months after a halving, reduced issuance typically drives scarcity narratives, and with it, the price begins to rise significantly. This attracts a wave of new STHs chasing momentum as prices begin to rise. During this phase, LTHs—often characterized by their lower cost basis and higher conviction—are more likely to sell into strength, realizing gains accrued during prior accumulation phases. As prices peak, a redistribution occurs, with STHs absorbing the supply from LTHs. Following the speculative mania of a market top, many STHs capitulate during the subsequent downturn, leading to a re-consolidation of bitcoin into the hands of LTHs. This cycle of redistribution not only reflects shifts in market sentiment but also highlights the resilience of LTHs, whose behavior stabilizes the market, setting the foundation for the next growth phase as the halving's scarcity effects reassert themselves.

Look at the chart below to see how the relationship between LTHs and STHs has played out in the past. The last time there were more short-term holders was in March 2021. The trend has been toward space consolidation and large long-term holders, taking more and more market share each cycle. Will we see STHs outnumber LTHs this cycle? Will this be a cycle top indicator? From the looks of it, we still have much more room to run. Only time will tell.Don’t go at it alone - During the bull phase of the bitcoin cycle, emotions often run high as prices surge and media attention intensifies. Prices of all digital assets start to appreciate significantly, and mania fills the air. If you’re trying to filter through the noise on your own, chances are you’ll make mistakes and could even lose money when everybody else is getting rich. Unless you’re glued to the internet 24/7, you won’t be an early investor in a popular altcoin. This will most likely lead to FOMO (fear of missing out) as you don’t want to be left behind on that awesome project that has done a 10x in 2 weeks. However, that impulsive decision will leave you holding the bag as the project loses 90% of its value over the subsequent weeks. It’s a storyline we’ve seen play out time and time again. There are now millions of investable crypto projects, and filtering out the good from the bad has never been more difficult. If you are looking to invest more than you can afford to lose, you can’t do it alone.

An advisor can provide objective, data-driven guidance to help investors identify sustainable opportunities while avoiding pitfalls, ensuring decisions are aligned with long-term goals rather than short-term hype. This is important in crypto because gains are amplified and occur 24/7. You have no downtime to research and digest why a coin is skyrocketing in price. Decisions on when to invest and what to buy need to be made holistically, zooming out on the entire crypto landscape and timeline. Professionals who have been through multiple cycles can follow crypto for a living and can help you actively manage your portfolio and grow your wealth, helping mitigate volatility along the way. While an active approach helps, it isn’t about trading every day. It’s about knowing when to size into bitcoin, what projects are now blue chip, what sectors provide opportunities for altcoin outperformance, and when stablecoins are a valuable asset. Don’t risk navigating the complexities of the crypto market alone.DAiM Performance

How DAiM benefits clients

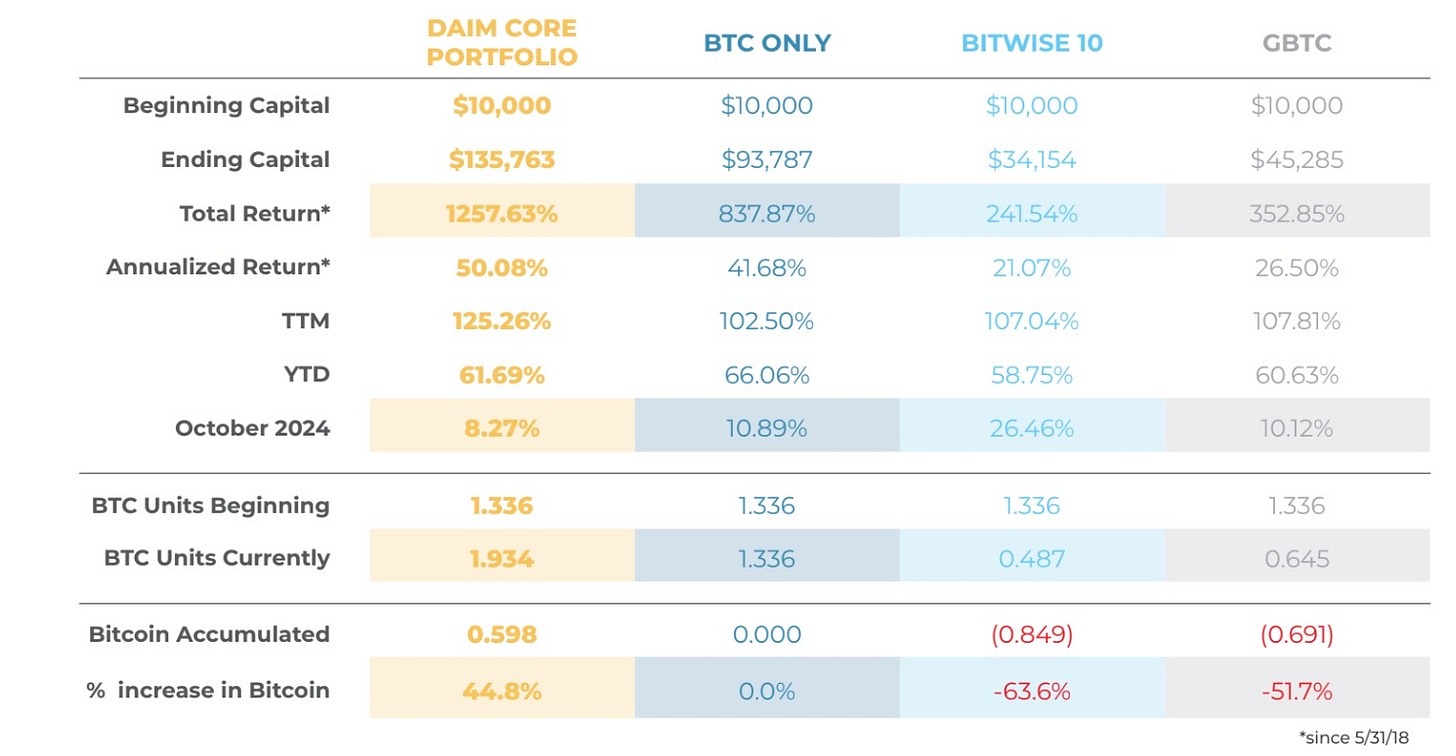

Model Portfolio: Our meticulously managed portfolio has consistently outperformed the simple strategy of buying and holding bitcoin alone by more than 419% since inception on 5/31/2018.

Wealth Management: As a licensed Registered Investment Advisor (RIA), we cater to clients with diverse financial needs, including Trust accounts, brokerage accounts, and IRAs. Our services encompass comprehensive tax strategies and audits to optimize your financial outcomes.

Tailored Solutions for Various Investors:

Individual Professionals: Busy individuals like doctors who lack the time to stay updated on market trends.

Altcoin Exposure in Retirement: Investors seeking exposure to alternative coins within their retirement accounts.

Intergenerational Wealth Planning: Large families aiming to create and manage intergenerational wealth, including gifting in bitcoin across multiple generations.

Simplified Management: Investors overwhelmed by the complexities of managing multiple wallets and decentralized exchanges (DEXes), finding it challenging to track or rebalance their assets promptly.

Enhanced Support and Communication: We understand the frustrations of navigating communication with crypto exchanges. At DAiM, we provide easy access to expert guidance, ensuring seamless communication for our clients.

Curious to Learn More About Investing with DAiM? Contact us at hq@daim.io