DAiM Issue 48

Welcome to DAiM's Newsletter. DAiM is a Registered Investment Advisor and award winning crypto asset manager. Please enjoy our thoughts below.

Treasury Play

What's the Strategy?

Preferred Options?

Look But Don’t Touch

Treasury Play - As bitcoin matures as an asset class and gains broader adoption, we’re seeing a wave of new financial products built around it. Headlines today are full of terms like Bitcoin Proxy, Bitcoin Treasury, and Bitcoin Bond. But before adding these to your portfolio, it’s worth asking: do they actually fit your financial goals?

We’re seeing more public companies — including some struggling or underperforming companies — announcing Bitcoin Treasury strategies to hold bitcoin on their balance sheets. But you have to ask: is this move benefiting you as a shareholder, or is it primarily serving the company’s own financial image?

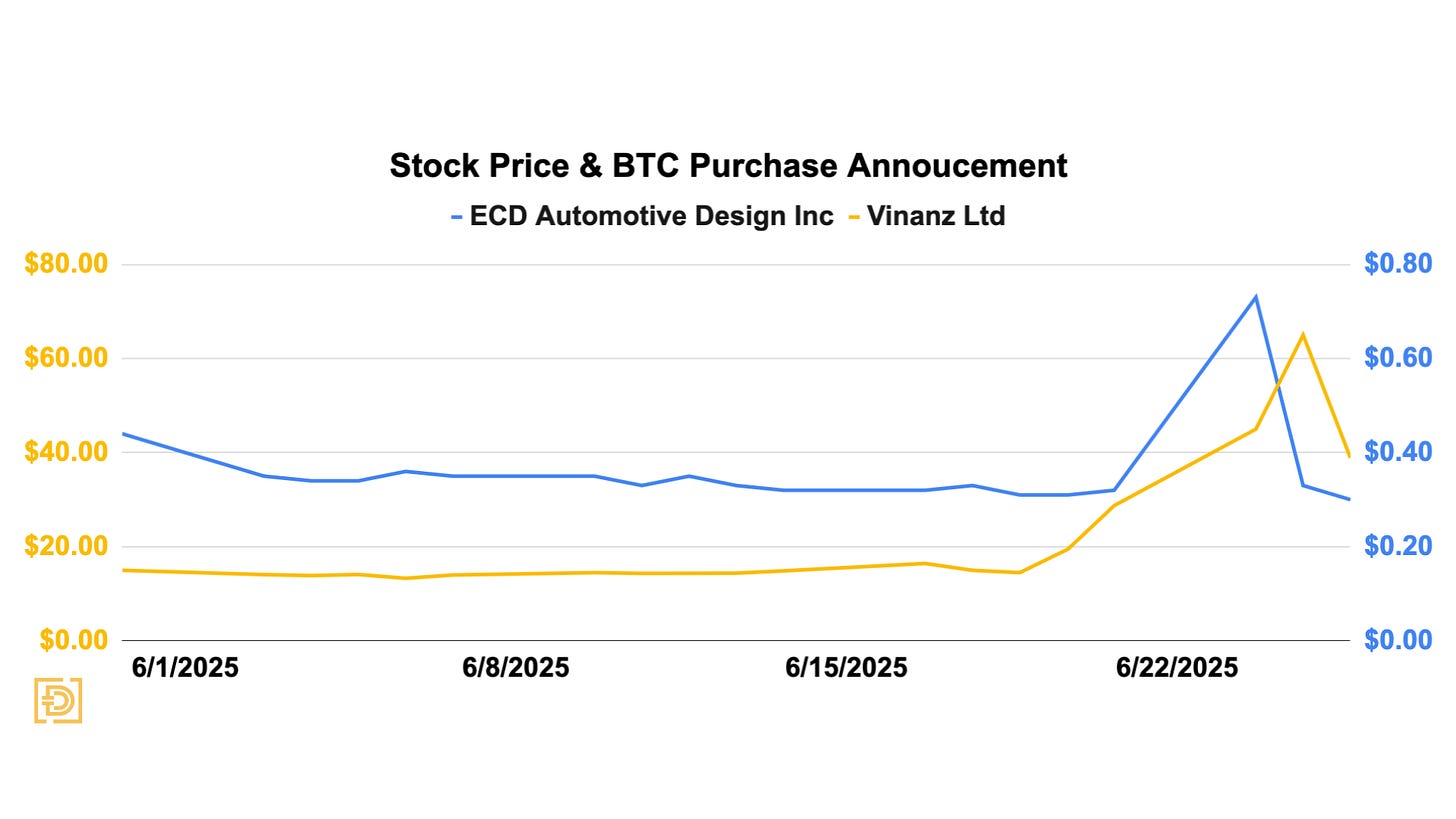

A responsible Bitcoin Treasury plan should outline how the bitcoin will be used, how it will reward shareholders, and how progress will be transparently reported over time. Anything less can quickly turn into a pump-and-dump scenario, leaving investors exposed, as seen recently with ECD Automotive Design Inc and Vinanz Ltd. Look at how their stocks traded in the two weeks leading up to and two days after their bitcoin announcements

Is that really the kind of exposure you want?

In the end, the simplest and most historically rewarding way to own bitcoin is to own bitcoin directly. There is no key man risk, no quarterly earnings surprises, and no competitive market cannibalization. Bitcoin is a rare, fixed-supply asset with a predictable monetary policy.

You can strengthen your strategy further by holding bitcoin in tax-advantaged accounts like IRAs, or by using selective borrowing to acquire more units when conditions are favorable — while keeping cash available for flexibility during market downturns. These are strategies we have been helping clients with since 2018.

Before chasing after the next quasi-bitcoin product, remember: nothing beats owning the real thing.

What's the Strategy? - Strategy, previously known as MicroStrategy, is the poster child for bitcoin-linked investments. Originally a business software and analytics company, it has transformed into the largest corporate holder of bitcoin. As bitcoin prices rose dramatically, Strategy’s ability to fund further purchases through its core business shrank. To solve this, the company issued securities to raise cash for more bitcoin buys.

The primary vehicle has been convertible bonds. These usually carry no or very low coupons, meaning Strategy avoids costly ongoing interest payments. Bondholders can convert these bonds to common stock at a future date, letting the company issue new shares instead of having to repay in cash. Convertible bonds have been extremely popular, but not only because of their conversion feature. Their popularity is largely driven by high implied volatility: bond investors who cannot directly own bitcoin can still get exposure to a product with bitcoin-like volatility through these convertibles.

For MSTR investors, these convertible bonds have trade-offs. Current shareholders benefit because the proceeds from the bonds go to buy more bitcoin, increasing their bitcoin-per-share exposure. But in the long run, these bonds could create significant dilution if many bondholders exercise the conversion feature. That’s why, for most long-term investors, owning bitcoin directly remains simpler and more transparent.

Preferred Options - Strategy expanded its "at-the-market" (ATM) security offering beyond convertibles by creating 3 distinct preferred share classes in 2025. Preferred shares generally appeal to investors seeking steady income over growth of principal. These Strategy preferreds have some unique features so its best to know what you are getting into before you buy.

STRD is a class of preferred shares that raised roughly $1 billion for Strategy to continue its bitcoin accumulation. Preferred shares appeal to investors thanks to a higher dividend and seniority over common stock in case of liquidation. STRD advertises a 10% dividend, but there are important caveats: the dividend is discretionary (Strategy can choose when or whether to pay) and non-cumulative (missed dividends don’t accrue). MSTR has never paid a dividend on its common shares, so whether it will pay on STRD is uncertain. The shares were initially sold at a discount, which was a key attraction for investors, but the actual yield will depend on future payouts that remain unproven.

STRK is another preferred share class, offering an $8 (8%) annual dividend on a $100 liquidation preference. If the price of STRK rises, its yield falls (happening now), and vice versa. Like STRD, its dividend is only paid if declared. So far, one quarterly dividend has been paid, with the next scheduled for June 30th. STRK also has a conversion feature: if Strategy’s share price reaches $1000, every 10 STRK shares can convert into one share of MSTR.

STRF is the most senior of the three preferred classes. It carries a 10% cumulative dividend, which compounds an extra 1% per year up to a maximum of 18% if dividends are missed. Strategy also retains the right to redeem STRF shares if fewer than 25% of the original issue remains outstanding, or under certain tax events.

In general, we recommend generating income through dividend-paying companies with a proven, stable track record of paying out income to shareholders. Strategy is an innovative firm that has repeatedly reinvented itself, and may continue paying these preferred dividends, but its ability to do so will likely rely on further financial engineering. These products are not inherently bad, they are just generally geared to a specific investor type. So make sure you know what type of investor you are.

Look But Don’t Touch - Finally there are companies issuing ETF products that take advantage of the buzz and brand behind Strategy. Two of the most popular types are below. We’ll explain them below for informational purposes, but strongly avoid investing in these strategies.

MSTY is an actively managed ETF that aims to generate high monthly income by selling call options on Strategy stock. These options are richly priced thanks to Strategy’s extreme volatility from its bitcoin holdings. This strategy can produce eye-catching annual yields exceeding 100% at times. However, a large portion of these distributions comes from return of capital, not true investment income.

For example, imagine you buy a share at $100, and it pays out $50 immediately as a dividend. Now your share is worth $50 and you hold $50 cash. You effectively got a 50% yield, but you still have the same amount ($100) you started with. Over time, repeatedly returning capital in this way can destroy the fund’s net asset value, leaving you with less principal despite receiving large payouts.

Leveraged ETFs promise a multiple (2x, 3x, etc.) of the daily return of an underlying stock like MSTR. In theory, if MSTR rises 50% over five days, a 2x (like MSTX) leveraged ETF should deliver 100%. In reality, these products reset their leverage every day, which causes performance to deviate dramatically from the simple multiple you might expect, especially over longer periods in volatile markets.

For example:

Day 1: MSTR falls 5%, from $100 to $95

Day 2: MSTR rises 5%, from $95 to $99.75Now, a 2x leveraged ETF:

Day 1: falls 10%, from $100 to $90

Day 2: rises 10%, from $90 to $99

After two days, the leveraged ETF is worth $99, lower than MSTR’s $99.75This “volatility drag” compounds over time and can leave investors with far less than they expect, especially if they hold the product too long through a choppy market.

If you want to invest in Strategy because you believe in Michael Saylor’s vision, that’s fine, just be sure you understand exactly which security you own, and the risks it carries. And steer clear of ETF sponsors trying to capitalize on Strategy’s name with products that sound enticing but take advantage of naive investors. Bottom line, be careful. We still recommend simply owning bitcoin directly and avoiding bitcoin-themed proxies. If you want to talk about strategies to complement a core bitcoin, let us know, we have some tools.

How DAiM benefits clients

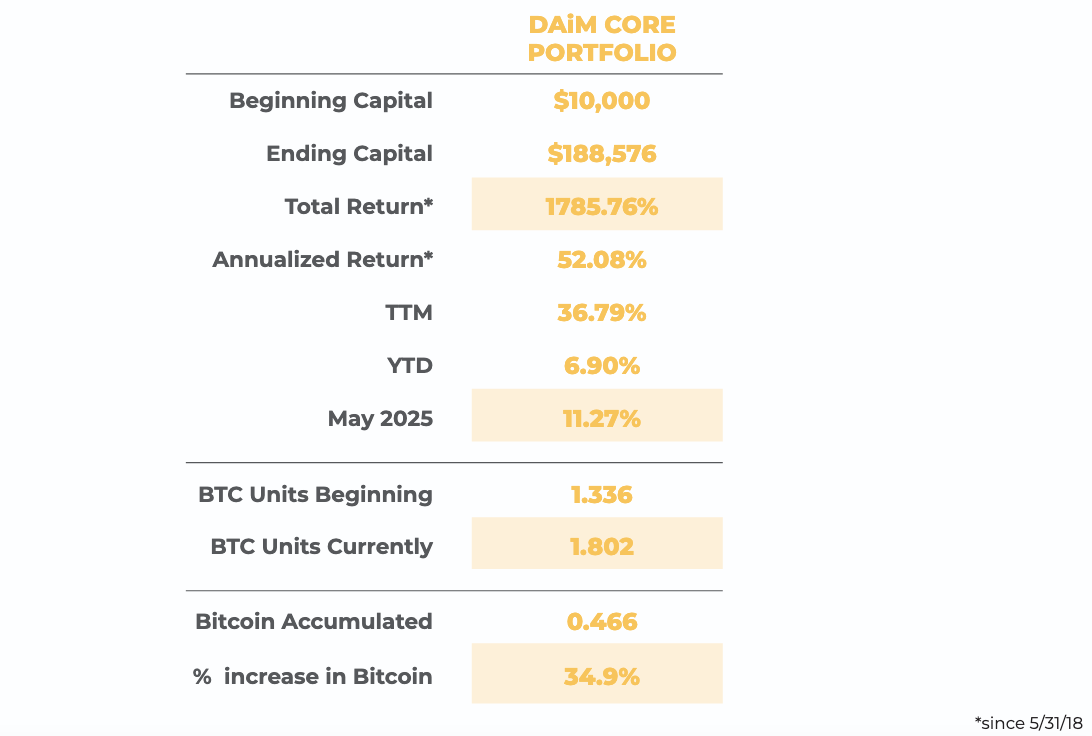

Model Portfolio: Our meticulously managed portfolio has consistently outperformed the simple strategy of buying and holding bitcoin alone by more than 487% since inception on 5/31/2018.

Wealth Management: As a licensed Registered Investment Advisor (RIA), we cater to clients with diverse financial needs, including Trust accounts, brokerage accounts, and IRAs. Our services encompass comprehensive tax strategies and audits to optimize your financial outcomes.

Tailored Solutions for Various Investors:

Individual Professionals: Busy individuals like doctors who lack the time to stay updated on market trends.

Altcoin Exposure in Retirement: Investors seeking exposure to alternative coins within their retirement accounts.

Intergenerational Wealth Planning: Large families aiming to create and manage intergenerational wealth, including gifting in bitcoin across multiple generations.

Simplified Management: Investors overwhelmed by the complexities of managing multiple wallets and decentralized exchanges (DEXes), finding it challenging to track or rebalance their assets promptly.

Bitcoin Options Trading: Investors looking to manage risk or generate additional yield through advanced strategies like bitcoin covered calls and zero-cost collars.

Bitcoin Lending: Investors seeking opportunities to lend their bitcoin and earn interest while retaining ownership of their assets.

Enhanced Support and Communication: We understand the frustrations of navigating communication with crypto exchanges. At DAiM, we provide easy access to expert guidance, ensuring seamless communication for our clients.

Curious to Learn More About Investing with DAiM? Contact us at hq@daim.io