DAiM Issue 49

Welcome to DAiM's Newsletter. DAiM is a Registered Investment Advisor and award winning crypto asset manager. Please enjoy our thoughts below.

History Repeating?

XRP Army

Video Series

History Repeating? - When Terra’s UST stablecoin collapsed in May 2022, it erased over $40 billion in market value, triggered a cascade of insolvencies across the crypto space, and served as a cautionary tale in overconfidence, flawed mechanics, and blind faith in a narrative.

At the time, Terra's pitch was compelling: a decentralized, algorithmic stablecoin backed by LUNA and supported by a BTC reserve, all wrapped in a yield-generating ecosystem (Anchor) that offered nearly 20% APY. It seemed “too big and too smart to fail.”

Then it failed. Spectacularly.

Fast forward to today, and the crypto landscape has matured in many ways. But a new form of groupthink has taken its place: the bitcoin treasury strategy. That is, companies, especially public ones, are raising debt or equity to accumulate bitcoin on their balance sheets under the belief that BTC’s long-term upside justifies the capital allocation.

At DAiM, we’re long-term bitcoin believers. But conviction should not lead to complacency. The parallels between Terra’s collapse and today’s BTC-on-balance-sheet movement offer important reminders.

In both cases, a belief in the strategy’s strength can obfuscate a weakness because risk management is replaced by narrative conviction. It was true for Terra and we will see how it plays out for these treasure

Terra’s ecosystem functioned as long as everyone believed the peg would hold. When doubts arose, UST holders rushed for the exit. That triggered a hyperinflationary loop in LUNA that broke the system in a matter of days. Despite BTC reserves, the model was fundamentally fragile because it relied on market psychology and the assumption that yield would keep capital in place.

The bitcoin treasury trend is gaining steam. MicroStrategy, miners, and other firms have made it clear that bitcoin is their core strategic asset. Some even borrow or issue equity to buy more.

The risk isn’t in owning bitcoin itself. It’s in how the asset is acquired and held.

Leverage introduces vulnerability in a volatile asset class. Issuing equity to buy BTC only makes sense if BTC significantly outperforms your share price. And when a company’s stock price becomes tightly correlated with bitcoin, negative feedback loops can emerge. A falling BTC price can lead to lower equity value, which limits fundraising options and reduces the capacity to accumulate more BTC, compounding downside exposure.

To put it differently, if a company borrows at 8 percent to buy BTC and BTC goes sideways or down, shareholders absorb the loss. Unlike sovereign nations or long-term holders, public companies are accountable to short-term markets and investor expectations.

At DAiM, we help clients invest in bitcoin within a clear, risk-aware framework that we transparently share with each of our clients. That includes using qualified custodians and regulated accounts such as IRAs, trusts, and brokerage accounts. We avoid leverage or risky “yield” schemes, proactively rebalance intelligently during volatility, and focus on bitcoin’s role as long-term, censorship-resistant property, not just a speculative asset.

Bitcoin does not need to be rescued by capital markets. It wins in the long run on its own merits. As fiduciaries, our role is not just to believe in bitcoin. It is to help clients navigate the right way to own it, without taking on unnecessary structural risk.

2022 was a wake-up call. It is important we do not hit snooze.

XRP Army - Are you enlisted? There may not be a more fervent group of supporters than Ripple (XRP) maxis. Since November, XRP is up more than 500%, going from $0.50 to over $3. While there are some catalysts, such as possible inclusion in a digital asset stockpile, the driving force seems to be hype. For example, look at this tweet (which received over 1 million views and 10k likes). It may seem like satire but we have spoken to a few prospects that have echoed that $10,000 per token number and even more who quote $1,000 as a price target. This extreme hopium has led to people holding crypto portfolios that we think are over concentrated in XRP. There are a couple of reasons why we don’t see these numbers materializing and why this line of thinking can be harmful for crypto investors.

As we pointed out back in January, we don’t see a path for Ripple supremacy in the crypto world. First and foremost, the Ripple Network works independently from the token. Therefore, there is no forcing function on the supply/demand of the token. If banks use the network that does not imply they are sending XRP instead of fiat bank to bank. The adoption of the Network does not mean an increase in demand for XRP or a decrease in supply. Additionally, it’s possible banks look for their own proprietary solutions. Proprietary solutions give banks more control from an operational and compliance standpoint.

Ripple also touches on another cognitive bias that we see in many crypto investors, called unit bias. Unit bias causes crypto investors to look at what one particular token costs rather than the market value of the token supply which provides a more accurate picture of how much an asset can appreciate in the future. In the case of XRP, many people see the token cost at only $3 and think that $1,000 or even $10,000 is extremely achievable. They think bitcoin is at $115k and ETH is at $3700 so XRP is extremely undervalued on a per token basis. The more important number to look at is total market cap. Market cap is a function of supply and current market price of the token. If you look at bitcoin there are about 19.9 million bitcoin in circulation at a current market price of $115,000. That makes the market cap about $2.2 trillion. XRP is at $3 a token with a circulating supply of about 60 billion. So its market cap is $3/token x 60B tokens or $180B. If XRP were to realistically get to $10,000/token that would put its market cap at $600 trillion. Keep in mind that this doesn’t factor into the supply that the Ripple team holds and could dump on the market. Anyway, back to market cap. $600T is equivalent to a bitcoin price of over $30,000,000 per coin. Additionally, the two largest publicly-traded companies, Nvidia and Microsoft, have market caps around $4T. So the amount of capital it would take to move the price of Ripple to a valuation 150x greater than the two largest companies in the world is so massive that we don’t see it as a realistic outcome.

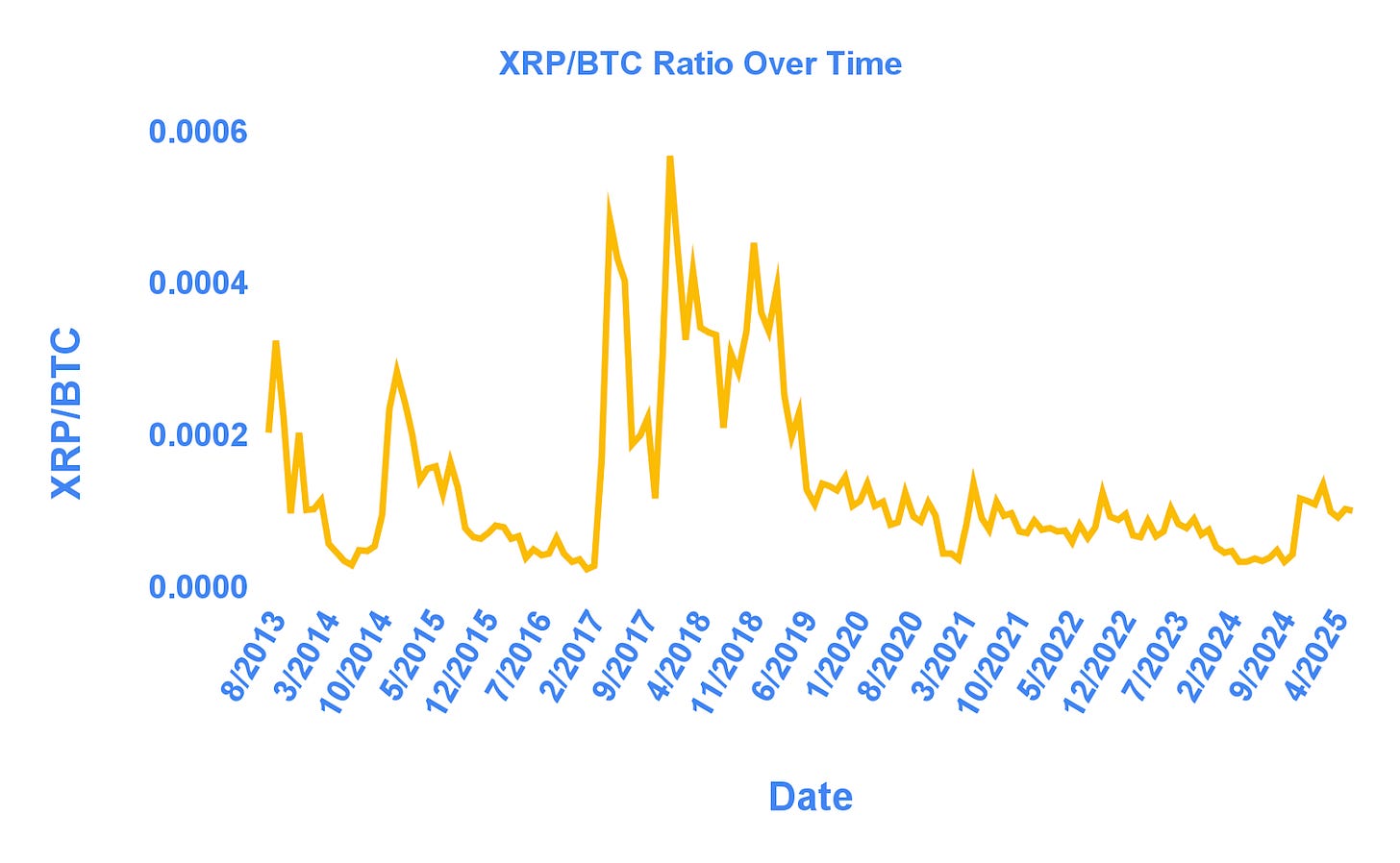

If you like XRP and want to hold it as part of a diversified portfolio, that is fine but we strongly feel it should be a small allocation relative to the bitcoin you hold. Keep in mind that XRP pumps every few years and outperforms bitcoin in small bursts. But the price action has never been maintained over long periods. Look at the historical xrp/btc ratio below.

The goal in crypto investing should be to stack sats (add more bitcoin to your portfolio). Allocating away from bitcoin is a strategic decision that can help you achieve this goal. However, from our experience, it should be done with extreme discipline. First, you only need about 5-10% portfolio allocated to altcoins to meaningfully take advantage of outperformance relative to bitcoin. Also, as you can see from the chart, these periods of outperformance are short-lived. Our feeling is that the opportunity to capture XRP outperformance this cycle happened in the run up from November to now. If you held XRP at $0.50 and still do, you can swap your XRP for about 4x as much bitcoin as you could have 8 months ago. That’s an offer we recommend taking 100 out of 100 times.Video Series - We’ve put together a 3-part series explaining our strategy and some basics on crypto investing. Here is the first video. Please share with anyone who is interested in investing in crypto.

How DAiM benefits clients

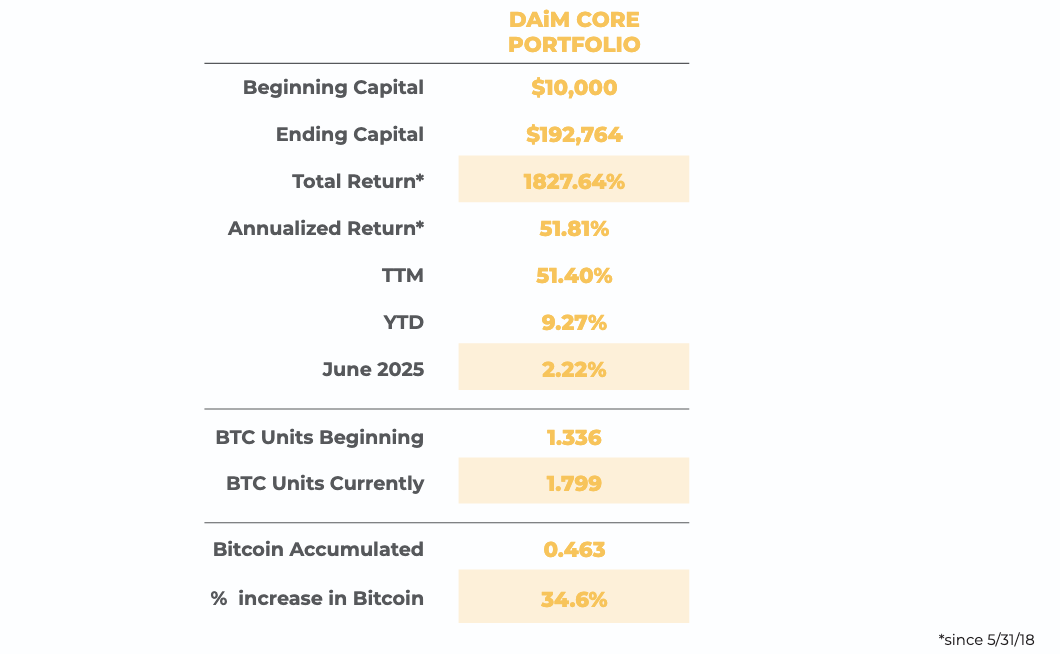

Model Portfolio: Our meticulously managed portfolio has consistently outperformed the simple strategy of buying and holding bitcoin alone by more than 495% since inception on 5/31/2018.

Wealth Management: As a licensed Registered Investment Advisor (RIA), we cater to clients with diverse financial needs, including Trust accounts, brokerage accounts, and IRAs. Our services encompass comprehensive tax strategies and audits to optimize your financial outcomes.

Tailored Solutions for Various Investors:

Individual Professionals: Busy individuals like doctors who lack the time to stay updated on market trends.

Altcoin Exposure in Retirement: Investors seeking exposure to alternative coins within their retirement accounts.

Intergenerational Wealth Planning: Large families aiming to create and manage intergenerational wealth, including gifting in bitcoin across multiple generations.

Simplified Management: Investors overwhelmed by the complexities of managing multiple wallets and decentralized exchanges (DEXes), finding it challenging to track or rebalance their assets promptly.

Bitcoin Options Trading: Investors looking to manage risk or generate additional yield through advanced strategies like bitcoin covered calls and zero-cost collars.

Bitcoin Lending: Investors seeking opportunities to lend their bitcoin and earn interest while retaining ownership of their assets.

Enhanced Support and Communication: We understand the frustrations of navigating communication with crypto exchanges. At DAiM, we provide easy access to expert guidance, ensuring seamless communication for our clients.

Curious to Learn More About Investing with DAiM? Contact us at hq@daim.io