DAiM Issue 50

Welcome to DAiM's Newsletter. DAiM is a Registered Investment Advisor and award winning crypto asset manager. Please enjoy our thoughts below.

Is This Time Different?

Macro Signals

GDP On Which Blockchain?

Getting Deep On RGB

Is This Time Different? - Bitcoin has a well-established cyclical pattern, with significant outperformance typically beginning approximately every four years, following its halving events, and peaking around November or December of the subsequent year. Then we enter a bear market with a pronounced 75%+ drawdown. But you don’t get extremely bullish price movement without feelings of FOMO and Euphoria. It’s around this time of the cycle when people start talking themselves into a “supercycle”. A supercycle is a lengthening of the 4-year bitcoin cycle as market participants talk themselves into a bullish cycle that can last many more years without a significant drawdown.

So is this time different? There are some unique elements that might sway crypto investors. Legislation aimed at providing regulatory clarity is moving forward, President Trump is openly supporting crypto in retirement accounts like 401(k)s, and talk of a national strategic crypto reserve is gaining traction. On the private side, crypto treasury firms are emerging rapidly, signaling growing institutional interest.With massive capital poised to flood into scarce digital assets, it’s easy to fall back into the “this time is different” mindset. And that’s without even factoring in Trump’s push to slash interest rates, a move that could weaken the dollar. Dollar debasement, after all, is central to Bitcoin’s core value proposition.

Don’t get too caught up in the hype. While we maintain a highly bullish long-term outlook, we do feel that an “up only” mode is a fantasy. Digital assets are still highly volatile and while bitcoin is the scarcest hard asset, scarcity cuts both ways. It is easy for demand to exceed supply and push prices up considerably. It is also easy for a few entities to sell a large percentage of the supply and crater prices.

That’s why investors need to keep their guard up. There are some common pitfalls late in the cycle that investors must keep in mind to make sure they position themselves best for the long-term.

First, do not use leverage. The psychology of a supercycle causes many people to try and amplify their returns by borrowing against their current crypto to buy more. This strategy usually does not work well for investors and when it does work it is best done at the beginning of a bitcoin cycle, not the tail end. Leverage often leads to day trading and magnifies ordinary corrections into forced liquidations.

Second, do not chase altcoin performance. Do not look for $500k market cap coins that “could” 50x over a couple weeks. Chances are these dart throws are just throwing away money. And if you do experience 100% or 200% return, take profits. Too many crypto investors stick around for the entire altcoin rollercoaster. Riding profits up to considerable heights only to hold too long and lose not just their gains but their initial principal.

The good news is that none of this undermines bitcoin’s long-term role as a scarce, durable asset. The key is survival: don’t overextend, don’t get lured into “this time is different,” and keep allocations grounded in a strategy you can stick with. If you avoid the leverage and altcoin traps, you can weather the storm and come out stronger on the other side.

Macro Signals - Bitcoin doesn’t exist in a vacuum. Its price is shaped not just by adoption or on-chain activity, but also by what’s happening in the broader economy. Right now, the macro backdrop is sending mixed but ultimately bullish signals for digital assets.

The U.S. economy is still running hot. Growth remains strong, and demand across sectors has held up better than many expected. Under normal circumstances, this would push the Federal Reserve to keep interest rates high, or even raise them further. At the same time, government debt continues to climb. While “cutting spending” is often mentioned as a solution, the reality is that federal spending rarely decreases. In fact, it almost always grows over time, adding more fuel to the long-term debt burden.

For years, the Fed has hammered home the idea of returning inflation to 2%. That target has been the north star of monetary policy. But recently, there was a notable shift: the Fed backed away from the rigid 2% goal and began emphasizing the employment picture instead.

This pivot matters. Unemployment has started to tick upward. Rising joblessness gives the Fed the data point it needs to justify cutting rates, potentially as soon as September, without looking like it’s bowing to political pressure. In other words, the Fed can claim it’s responding to labor market weakness, not simply making it easier for the White House during an election cycle.

Markets reacted immediately. As soon as the Fed signaled a more flexible stance, Bitcoin and other digital assets surged. Lower interest rates reduce the cost of borrowing and boost risk appetite, creating a favorable backdrop for assets with strong long-term growth potential. In these conditions, Bitcoin often outperforms, as investors move further out on the risk curve in search of asymmetric opportunities.

The next stage could be even more important. Institutional investors, such as pension funds and endowments, will now sit down with their investment committees and reassess their portfolios. If rates are indeed headed lower, that opens the door to fresh allocations, and given the scale of institutional capital, even modest shifts can translate into billions flowing into digital assets.

The result? A macro-driven tailwind that could extend the current bull market longer than many expected.

The Fed’s pivot is a reminder that macro conditions remain one of the most important drivers of bitcoin’s price. Investors should welcome the potential tailwinds but avoid complacency. Policy can shift quickly, and markets can overreact in both directions. For long-term holders, the lesson is clear: keep conviction, but don’t forget discipline.

Recently, U.S. Commerce Secretary Howard Lutnick suggested that the government could start publishing official GDP figures on a blockchain. The idea sounds groundbreaking, but what does it actually mean for crypto investors?

In theory, putting data like GDP on a blockchain would make it immutable and transparent. Once published, the numbers couldn't be quietly revised or concealed, and anyone could verify when and how changes were made. That’s exactly what drew attention to the idea, those same qualities are what make Bitcoin reliable and trustworthy. But there’s an important difference. Bitcoin is governed by strict rules of supply and transaction validation. GDP data, on the other hand, is still produced by people and institutions. Even if it ends up on a blockchain, investors would still need to trust the government’s methods of gathering and reporting the numbers. The blockchain can lock in the distribution of data, but it doesn’t guarantee the accuracy of the data itself.

A good example of this in action is Estonia. The country relies on a blockchain-based system to protect government records like healthcare data, court filings, and land registries. Rather than replacing the way data is collected, blockchain simply ensures no one can alter the records once they’re published. If the U.S. were to follow suit, publishing GDP on-chain would be more about ensuring permanence and legitimacy than changing the underlying numbers.

What’s unclear is which blockchain the U.S. might use. It could choose a public chain like Solana, Stellar, or XRP, which would immediately get the crypto market buzzing. Or it could build its own government-controlled chain, prioritizing security and control over public visibility. There’s even a possibility of a hybrid approach, anchoring a hash on a public chain like bitcoin while storing the actual data on government servers. Each option carries different trade-offs, but any announcement would have a short-term impact on whichever token gets the nod.

For investors, this is more of a sentiment story than a fundamental shift. In the short run, naming a blockchain in an official U.S. government announcement would likely spark a price reaction. Over the long run, though, the bigger story is the signal that blockchain is moving further into the mainstream. GDP data on-chain won’t change how the economy is measured, but it could legitimize blockchain as part of the infrastructure of modern governance. And if that happens, it adds one more building block to crypto’s case for staying power.

Getting Deep On RGB: Stablecoins on Bitcoin are here. Tether is set to launch USDT on Bitcoin using Lightning and the RGB protocol. Want to dive deeper into what this means for Bitcoin’s future? Check this out: https://trustmachines.co/learn/what-is-the-rgb-protocol-on-bitcoin/

How DAiM benefits clients

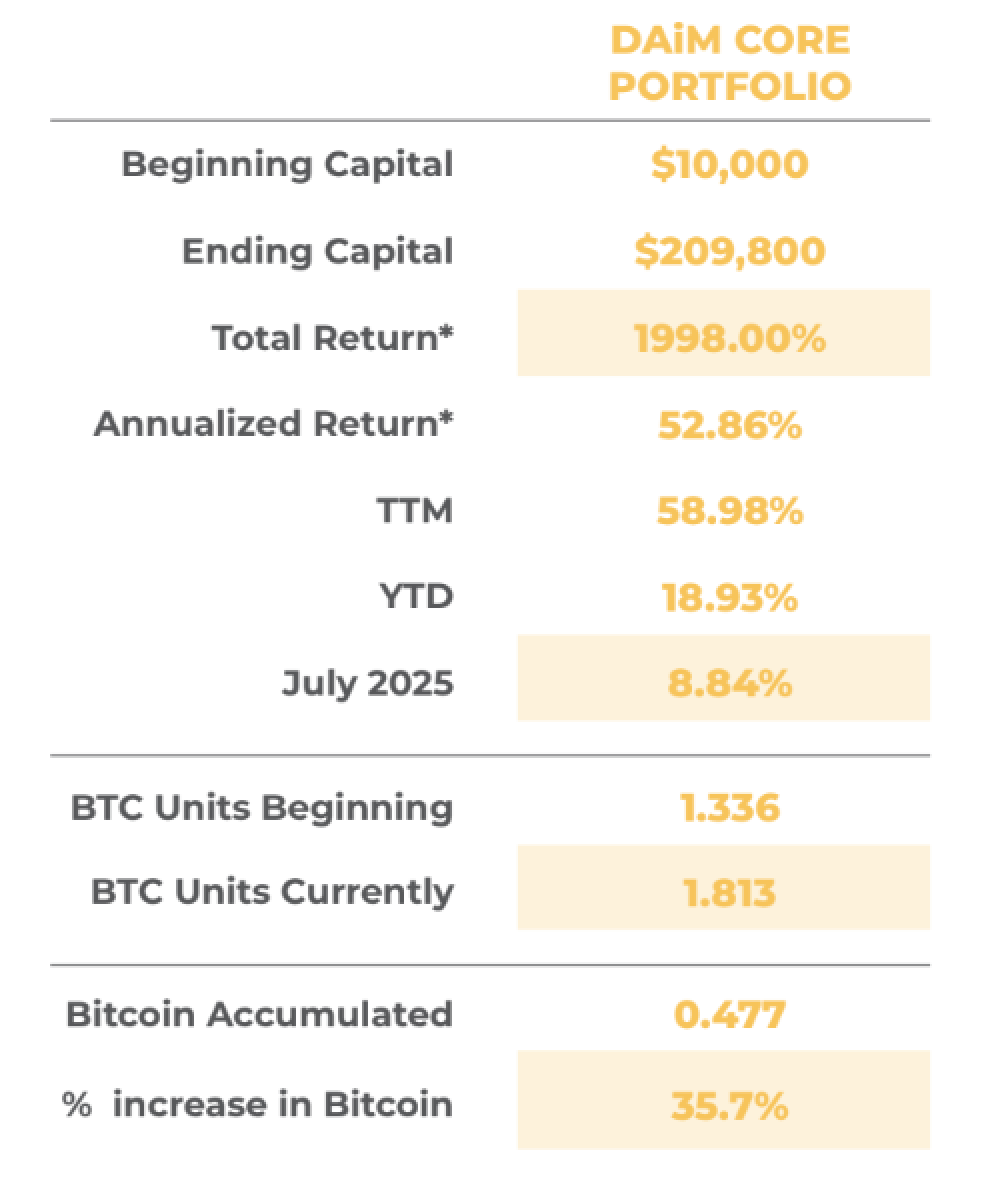

Model Portfolio: Our meticulously managed portfolio has consistently outperformed the simple strategy of buying and holding bitcoin alone by more than 551% since inception on 5/31/2018.

Wealth Management: As a licensed Registered Investment Advisor (RIA), we cater to clients with diverse financial needs, including Trust accounts, brokerage accounts, and IRAs. Our services encompass comprehensive tax strategies and audits to optimize your financial outcomes.

Tailored Solutions for Various Investors:

Individual Professionals: Busy individuals like doctors who lack the time to stay updated on market trends.

Altcoin Exposure in Retirement: Investors seeking exposure to alternative coins within their retirement accounts.

Intergenerational Wealth Planning: Large families aiming to create and manage intergenerational wealth, including gifting in bitcoin across multiple generations.

Simplified Management: Investors overwhelmed by the complexities of managing multiple wallets and decentralized exchanges (DEXes), finding it challenging to track or rebalance their assets promptly.

Bitcoin Options Trading: Investors looking to manage risk or generate additional yield through advanced strategies like bitcoin covered calls and zero-cost collars.

Bitcoin Lending: Investors seeking opportunities to lend their bitcoin and earn interest while retaining ownership of their assets.

Enhanced Support and Communication: We understand the frustrations of navigating communication with crypto exchanges. At DAiM, we provide easy access to expert guidance, ensuring seamless communication for our clients.

Curious to Learn More About Investing with DAiM? Contact us at hq@daim.io