DAiM Issue 52

Welcome to DAiM's Newsletter. DAiM is a Registered Investment Advisor and award winning crypto asset manager. Please enjoy our thoughts below.

“The best way to invest is to diversify and hold a portfolio of quality assets that you believe in for the long term, rather than chasing speculative trends. Enduring through market cycles is key to lasting wealth.” - Ray Dalio

Signals Are Flashing

A Year Of Very Shallow Dips

Quantum Computing

Solana

Signals Are Flashing - Markets don’t move in straight lines, and in this cycle, Bitcoin has shown a remarkably consistent rhythm in how it corrects and recovers. A pattern we’ve observed in 2025: Bitcoin tends to bottom out 17–22 days after peaking, before resuming its upward trajectory. That cadence may be playing out again right now, and sentiment indicators are lining up to support that view.

Two reliable indicators we monitor for reversal signals. Crypto Fear & Greed Index: On October 21st the reading was 29, firmly in the “Fear Zone”. This index has remained under 40 since October 10, with levels below 30 historically signaling a strong short-term bottoming opportunity. VIX (Volatility Index): After spiking to 25 last week, the VIX has cooled back down to 16. Historically, when VIX is above 20 and Fear & Greed drops below 30, Bitcoin tends to move higher soon after. These are classic contrarian signals. When broader markets are fearful and volatility spikes, it often marks capitulation and the start of accumulation, the early phase of a breakout.

Bitcoin reached an all-time high on October 6th and has since experienced a downward trend, causing concern among investors. With sentiment already putting in some time in the fear zone, we may be entering the final stage of the current consolidation. If the 17–22 day downward slide trend holds true again, counting from early October, we could see renewed upward momentum any day. This is not the only pattern; in the next section, we will cover what else is emerging as a positive catalyst.

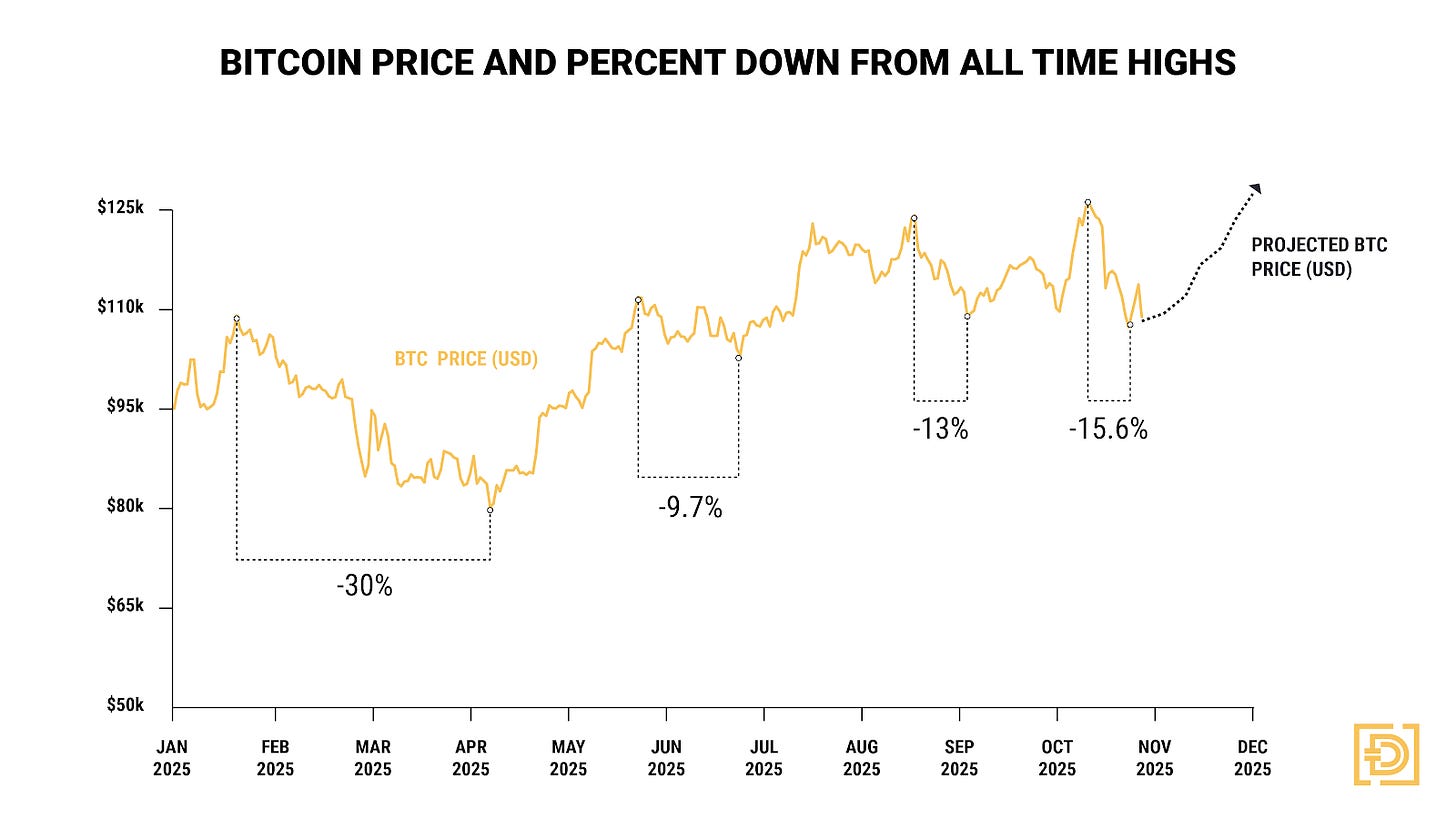

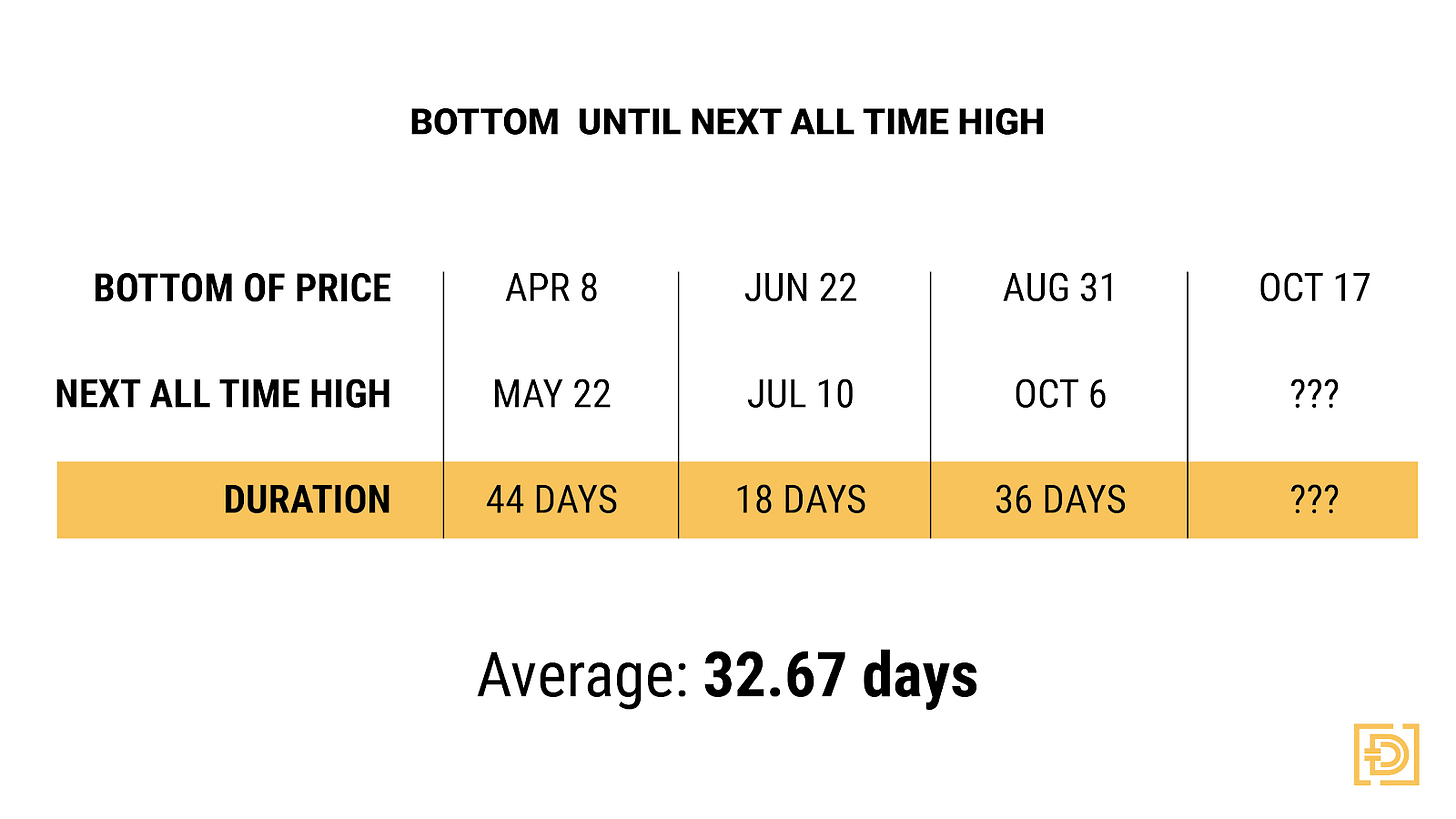

Shallow Dips - While volatility is nothing new in crypto, 2025 is quietly becoming one of the most structurally resilient Bitcoin periods ever recorded. This year’s pullbacks haven’t just been short-lived, they’ve been historically shallow in both depth and duration. Let’s look at the four notable pullbacks year-to-date:

Across these three corrections, the average duration has been just 32.7 days before reaching a new all-time high, remarkably short compared to previous cycles where pullbacks often stretched 60–90 days or more.

Bitcoin reached a local low on October 6th and has maintained its position despite selling pressure from long-term holders (those who have held for 155 days, which, while significant, is not a full year). If this support continues and the historical 32–33 day recovery timeline holds, Bitcoin could see new all-time highs by early to mid-November.

Why does this matter? Minimal pullbacks signal strong underlying demand and conviction from both retail and institutional investors. Faster recoveries reinforce the thesis that Bitcoin is maturing as an asset class, with growing stability in bull markets.Quantum Computing - Over the years, we have fielded emails with questions about quantum computing and Bitcoin – and we’re excited to share the good news: This isn’t an imminent threat; there is plenty of time to turn this into an opportunity for Bitcoin to evolve and thrive. Prominent Bitcoin leaders agree: any real risks are decades away, and our network is already built to stay ahead. Bitcoin’s current bull cycle has experienced record-low pullbacks, proving investor confidence is strong. We’ll break it down with simple insights – and see how quantum tech could actually benefit BTC.

Most estimates suggest we are decades away from quantum computers with the millions of error-corrected qubits needed to pose a realistic threat. If the risk were near-term, we’d expect to see panic reflected in Bitcoin’s price. Instead, the current market cycle has experienced the smallest pullbacks on record, reinforcing Bitcoin’s resilience and investor confidence.

Bitcoin’s network is designed with robust, built-in security features that help protect against emerging technology risks, including potential quantum threats. Best practices, such as discouraging the reuse of deposit addresses, ensure that sensitive information remains protected, and reputable custodians follow strict protocols that add additional layers of safety. The use of multi-layer encryption, institutional-grade security, and regulatory compliance ensures that client assets are safeguarded at the highest industry standards. In addition, modern wallets and institutions continuously adopt innovations like Taproot and enhanced address management, which keep transaction details secure and significantly reduce quantum-related risks.

Moreover, quantum computers wouldn’t be able to “speed-run” the blockchain to rewrite history or steal coins at will. Mining still requires controlling a majority of the network’s hash power, and even then, rogue blocks would be rejected by full nodes for violating consensus rules.

The Bitcoin development community isn’t waiting for quantum threats to materialize, it’s building proactive solutions today. A proposed upgrade called Pay to Quantum Resistant Hash (P2QR) will introduce quantum-safe signature schemes like FALCON and SPHINCS+. Testnets are already in motion, with a soft fork rollout potentially in 2026, once implementation is proven stable. Ethereum’s long-term roadmap includes zk-STARK integration for quantum-resistant security. This upgrade is expected around 2027 and would enable users to authenticate transactions with post-quantum cryptography.

Interestingly, some in the AI and cryptography communities argue that quantum computing could become a net positive for Bitcoin by:

Enhancing privacy

Improving mining efficiency

Reinforcing Bitcoin’s position as a future-proof digital asset

Strengthening long-term security infrastructure

Developers like Jameson Lopp and Hunter Beast are already laying the groundwork for quantum-resistant upgrades, reflecting a broader commitment to keeping Bitcoin secure, adaptive, and investable.

Solana - For the lifetime of crypto, the industry has consistently used Western Union and its outdated payment systems as an example of an inefficient financial transaction processor, envisioning a future where crypto would revolutionize this. Western Union has chosen the Solana network as its stablecoin for payments, marking a significant step from use case to real-world application. Further boosting Solana’s appeal, the SOL ETF by Bitwise launched yesterday, attracting a reported $69.5 million in investments, significantly outperforming other altcoin ETFs, with the second highest, HBR, bringing in $8 million. When we added Solana to our Model Portfolio back in 2023, these were the types of developments we anticipated, and it’s incredibly rewarding to see them unfold. We are confident that even greater advancements are on the horizon!

How DAiM benefits clients

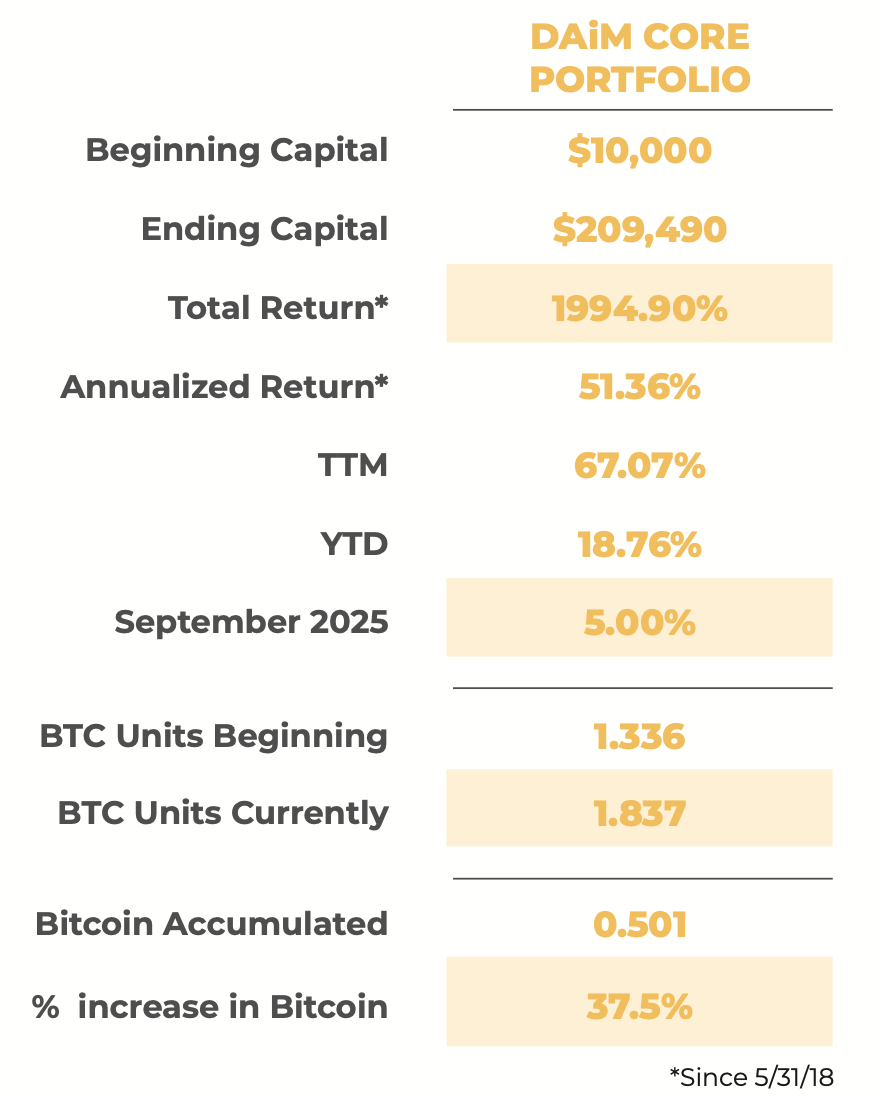

Model Portfolio: Our meticulously managed portfolio has consistently outperformed the simple strategy of buying and holding bitcoin alone by more than 570% since inception on 5/31/2018.

Wealth Management: As a licensed Registered Investment Advisor (RIA), we cater to clients with diverse financial needs, including Trust accounts, brokerage accounts, and IRAs. Our services encompass comprehensive tax strategies and audits to optimize your financial outcomes.

Tailored Solutions for Various Investors:

Individual Professionals: Busy individuals like doctors who lack the time to stay updated on market trends.

Altcoin Exposure in Retirement: Investors seeking exposure to alternative coins within their retirement accounts.

Intergenerational Wealth Planning: Large families aiming to create and manage intergenerational wealth, including gifting in bitcoin across multiple generations.

Simplified Management: Investors overwhelmed by the complexities of managing multiple wallets and decentralized exchanges (DEXes), finding it challenging to track or rebalance their assets promptly.

Bitcoin Options Trading: Investors looking to manage risk or generate additional yield through advanced strategies like bitcoin covered calls and zero-cost collars.

Bitcoin Lending: Investors seeking opportunities to lend their bitcoin and earn interest while retaining ownership of their assets.

Enhanced Support and Communication: We understand the frustrations of navigating communication with crypto exchanges. At DAiM, we provide easy access to expert guidance, ensuring seamless communication for our clients.

Curious to Learn More About Investing with DAiM? Contact us at hq@daim.io