DAiM Issue 53

Welcome to DAiM's Newsletter. DAiM is a Registered Investment Advisor and award winning crypto asset manager. Please enjoy our thoughts below.

Bitcoin History - bitcoin went through a 54% correction during its 2021 bull market, falling from the April peak of ~$64,800 to a July low of ~$29,000. Just four months later, it fully recovered and surpassed the prior high, reaching a new all-time high of ~$69,000 in November 2021.

Down But Not Out

The Feeling of Pullbacks: Dollars vs. Percentages

Estate Planning

Down But Not Out - Bitcoin recently pulled back about 36% from its all-time high near $126,000. For anyone new to bitcoin, that kind of move feels dramatic. For anyone who has lived through multiple cycles, it’s business as usual. Drawdowns of 30–40% have occurred in nearly every major bull run. These aren’t signs of weakness; they’re simply how a scarce, globally traded asset behaves when demand ebbs or large holders sell into thin liquidity.

Bitcoin’s fixed supply accelerates both directions. When demand surges, price moves aggressively upward. When demand temporarily disappears, price can drop just as fast.

Trying to time these moves almost always leads to worse results. Successful long-term investors typically maintain consistent allocations, hold through volatility, add to positions during meaningful drawdowns, and avoid emotional trading based on headlines. The long-term track record is clear: patience and discipline win. Down but not out is how bitcoin works.

The Feeling of Pullbacks: Dollars vs. Percentages - From October through November, we saw something new: bitcoin experienced its first 30% pullback while trading above $100,000 for a sustained six-month period. Prior to this cycle, bitcoin had never traded anywhere near the $100k level, so investors had no historical reference point for this kind of dollar-denominated volatility.

This time, with bitcoin reaching $126,000, the selloff hit differently, especially for those holding whole units. A 30% pullback at six-figure prices produces highly visible, emotionally uncomfortable losses. Someone holding 10 BTC saw their portfolio value drop by more than $300,000, while a holder of 1 BTC saw a $30,000 decline. Because these are round, meaningful dollar amounts, the drawdown felt more painful, even though 30% pullbacks are common in bitcoin bull cycles.

Looking ahead, if bitcoin is trading at $200,000 in the future, a routine 30% pullback will show even larger dollar declines. A 10-BTC investor would experience a temporary $600,000 drop, while a 1-BTC holder would see $60,000 evaporate on paper. Same percentage move, much larger notional value.

This matters because investors often mentally anchor to what those unrealized losses could have purchased a home, a car, or a vacation property. Acting on that emotion can be destructive. If you sell bitcoin after a 30% drop to raise $600,000 for a purchase, you’re not just funding the home, you’re locking in a loss that permanently dents your long-term upside. When bitcoin eventually recovers back to $200,000, instead of your portfolio returning to $2 million, it only rebounds to $1.4 million.

This is why disciplined planning matters. As advisors, we’re seeing more clearly than ever how important it is to have a long-term financial plan specifically for your crypto holdings. We fully support using bitcoin for life-changing milestones, but the key is to plan those sales years in advance, not react in the middle of market volatility. Strategic, pre-planned liquidation lets you enjoy your wealth without sabotaging your compounding.

Estate Planning - The recent whale selling highlights a major challenge facing more long-tenured bitcoin holders: How do you secure and transfer digital wealth responsibly? Millions of people now hold assets purchased years ago that have grown into meaningful generational wealth, but most still lack a plan. As crypto enters the mainstream, estate planning becomes just as important as asset allocation.

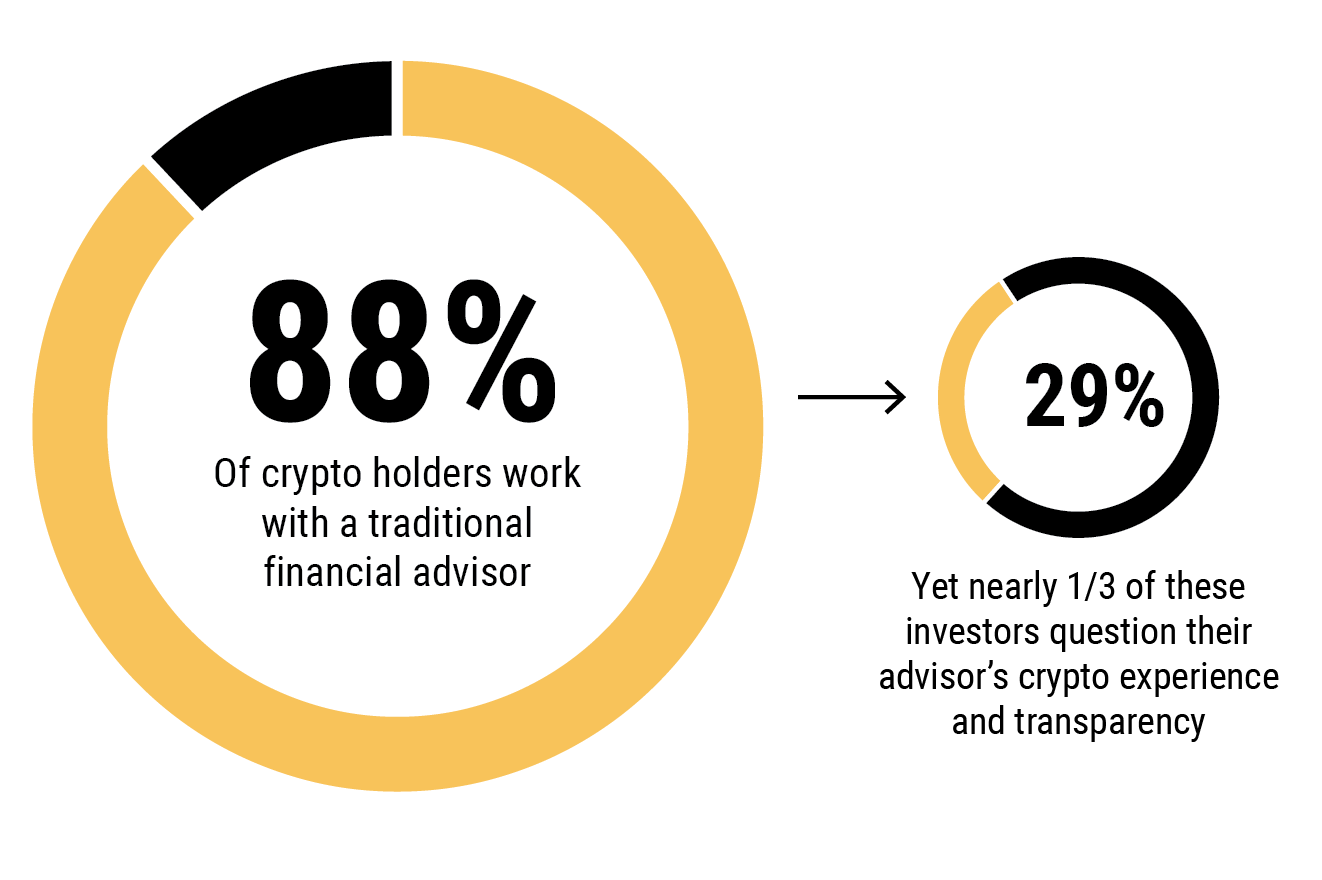

Investors already want help, but aren’t getting the right expertise. Recent data shows that 82% of wealthy investors want advisors who understand crypto, 88% of crypto holders already work with a traditional advisor, and 29% doubt their advisor’s crypto knowledge and transparency. The disconnect is clear: investors want professional guidance, but many advisors aren’t equipped for digital assets.

A skilled crypto advisor can structure a tailored allocation strategy, whether single-token, index-based, or diversified. They can manage volatility with risk-aware rebalancing, educate families about custody, compliance, and risks, and build integrated tax, estate, and legacy plans that include bitcoin.

Estate planning must cover secure and recoverable custody, beneficiary processes that actually work in practice, digital asset provisions in wills or trusts, documentation heirs can follow, and tax-efficient distribution strategies over time. Because bitcoin doesn’t automatically pass to loved ones, if access is lost, the wealth is gone. Full stop.

You worked hard to build your bitcoin position. A fiduciary advisor who understands crypto ensures it remains protected, tax-efficient, and transferable, now and for future generations. If you’re holding a meaningful amount of digital assets and don’t yet have a plan for future liquidity events, now is the time to create one. Schedule a conversation with us so we can help you map out a strategy that protects your upside and supports the life you want to build.

How DAiM benefits clients

Model Portfolio: Our meticulously managed portfolio has outperformed the simple strategy of buying and holding bitcoin alone by more than 540% since inception on 5/31/2018.

Wealth Management: As a licensed Registered Investment Advisor (RIA), we cater to clients with diverse financial needs, including Trust accounts, brokerage accounts, and IRAs. Our services encompass comprehensive tax strategies and audits to optimize your financial outcomes.

Tailored Solutions for Various Investors:

Individual Professionals: Busy individuals like doctors who lack the time to stay updated on market trends.

Altcoin Exposure in Retirement: Investors seeking exposure to alternative coins within their retirement accounts.

Intergenerational Wealth Planning: Large families aiming to create and manage intergenerational wealth, including gifting in bitcoin across multiple generations.

Simplified Management: Investors struggling with the complexity of juggling multiple wallets, decentralized exchanges, and manual tracking.

Bitcoin Options Trading: Investors looking to manage risk or generate additional yield through advanced strategies like bitcoin covered calls and zero-cost collars.

Bitcoin Lending: Investors seeking opportunities to lend their bitcoin and earn interest while retaining ownership of their assets.

Estate and Tax: Investors needing to protect their assets and understand taxes.

Enhanced Support and Communication: We understand the frustrations of navigating communication with crypto exchanges. At DAiM, we provide easy access to expert guidance, ensuring seamless communication for our clients.

Curious to Learn More About Investing with DAiM? Contact us at hq@daim.io