DAiM Issue 54

Welcome to DAiM's Newsletter. DAiM is a Registered Investment Advisor and award winning crypto asset manager. Please enjoy our thoughts below.

“The key to being a successful investor is to be aggressively patient.”

— Stan Druckenmiller

Shrinking Inflows

Capital Rotation

Birthgap

Noteworthy

Shrinking Inflows - It is reasonable to expect bitcoin ETF inflows to slow in the medium term and eventually level out. Periods of unusually large inflows often coincide with new access points coming online. Early months tend to attract outsized capital as investors who were previously sidelined gain a new way to allocate.

That front-loaded demand does not persist indefinitely, and it does not need to.

A useful comparison is gold. Gold ETFs have existed for more than two decades. Today, monthly inflows are relatively modest compared to bitcoin’s recent ETF launches. Yet gold has still doubled in price over the last several years. Price appreciation did not require accelerating inflows, only sustained ownership and limited available supply at the margin.

This is where bitcoin differs in an important way. Gold supply increases every year as new metal is mined. Bitcoin’s supply does not. Issuance is fixed and continues to decline over time.

As the market matures and inflows normalize, price becomes increasingly sensitive to small imbalances between supply and demand. With fewer new coins entering circulation and a growing base of long-term holders, bitcoin can move higher even on lighter inflows.

The risk is not that inflows slow. The risk is focusing on flows instead of structure.

Capital Rotation - As headline inflows normalize, the next phase of demand is likely to come from capital rotation rather than entirely new capital entering the system.

One of the most credible near-term sources is institutional commodity capital, particularly allocations currently held in gold. Rotation from traditional commodities into bitcoin is already happening at the margin, and there is a clear path for this cohort to become a meaningful incremental buyer over the next cycle, even if the process is gradual rather than abrupt.

From a portfolio construction standpoint, the logic is increasingly compelling. Bitcoin has shown low to neutral long-term correlations with broad commodity baskets, while gold remains more closely linked to bonds and traditional commodity exposures. For multi-asset portfolios that already own gold, energy, and industrial metals, bitcoin is increasingly evaluated as part of the “real asset” or “inflation hedge” allocation rather than as a technology proxy.

Market behavior reinforces this framing. During periods of geopolitical stress, strength in gold prices has often coincided with positive short-term performance in bitcoin, while oil’s influence has been weak or insignificant. This suggests that a growing segment of investors already group bitcoin mentally alongside hard assets.

The primary friction is structural. Commodity allocators typically operate within benchmarks and mandates that do not yet include bitcoin. Adding exposure requires governance changes, not just a trade. As benchmarks evolve and mandates are updated, the most realistic outcome is not a wholesale exit from commodities, but a steady reweighting where a portion of gold and commodity exposure migrates toward bitcoin through ETFs and mandate-compliant structures.

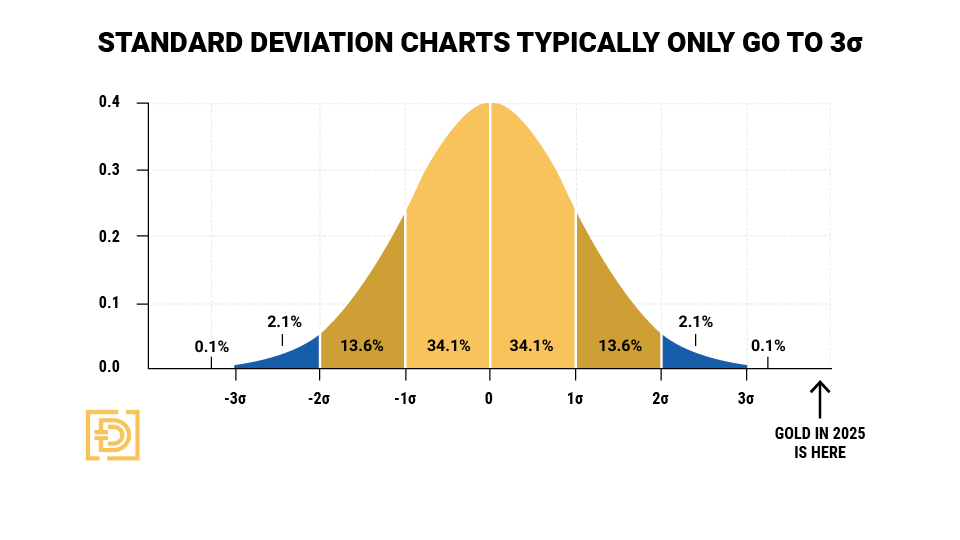

Gold’s recent move adds pressure to this process. Gold’s volatility (and its price) recently hit extreme highs and was found to be trading ~4 standard deviations above its long‑term average in late 2025. A standard deviation chart shows how much a set of values, such as prices, typically vary from their average. In a normal distribution, roughly 16% of outcomes occur more than one standard deviation above the mean, about 2.3% occur above two, and nearly all observations (about 99.7%) fall within three standard deviations of the mean. Moves beyond three standard deviations are rare and often prompt portfolio review and rebalancing discussions rather than incremental buying.

The scale of standard deviations:

Above 1 standard deviation → typical, happens about 16% of the time

Above 2 standard deviations → uncommon but still within normal statistical expectations, about 2.3% of the time

Above 3 standard deviations → rare, about 0.13% of the time

Above 4 standard deviations → very rare, about 0.003% of the time, or roughly 43x more rare than a 3-standard-deviation move

Moves of this magnitude do not tend to last and degree of price reversion is almost certainly expected. If it does, and to what extent remains to be seen. Regardless, gold doesn’t have to fall significantly for bitcoin to benefit. But when positioning and expectations become stretched, investors must reassess diversification and forward-looking return potential. For portfolios that already hold significant gold exposure but little or no bitcoin, that reassessment increasingly includes bitcoin.

Even modest reallocations are meaningful. A 2 to 5 percent shift from gold into bitcoin over several years would represent tens of billions of dollars in potential flows from this cohort alone. With post-halving bitcoin supply remaining thin, even incremental, rules-driven capital can have an outsized impact on price.

Birthgap - Global population is still growing, but something fundamental has changed. Birth rates are falling, and they have been falling for decades. What began in the 1970s as a developed-world phenomenon is now a global one.

The consequences are structural. Aging populations with fewer caregivers. Entire cities with excess housing and underused infrastructure. Labor migrating from stagnant regions to a smaller number of economic hubs. These are not short-term cycles. They are long-duration demographic shifts.

The documentary Birthgap explores the drivers behind this trend and reaches a counterintuitive conclusion. Declining birth rates are not primarily caused by war, cultural liberalization, or people choosing more leisure. The dominant factor is economic stress. Periods where everything feels more expensive, including housing, education, and healthcare, create uncertainty. That uncertainty leads families to delay or forgo having children altogether. Over time, that mindset compounds and is passed down to the next generation.This matters because governments increasingly understand what another major recession would mean in a world already facing demographic decline. A shock like 2008, layered on top of falling birth rates, does not just damage the economy in the short term. It risks permanently impairing future population growth and labor force participation.

As a result, the policy response is changing. When population growth slows and neutral interest rates fall, governments lose the ability to rely on organic economic expansion. Stimulus becomes the default tool, not the emergency one. Fiscal expansion, monetary accommodation, and more centralized economic management are no longer optional. They are necessary to keep the system functioning.

In that environment, assets that cannot be inflated become increasingly valuable. Bitcoin sits at the extreme end of that spectrum which makes it the most valuable asset. It has a fixed supply, is globally liquid, and operates outside the control of any government or central bank. As policymakers lean more heavily on stimulus to offset demographic decline, the purchasing power of fiat currencies is steadily diluted.

For long-term investors, this makes bitcoin less a speculative asset and more a form of structural insurance. A growing number of individuals, institutions, and even governments are responding the same way. They are allocating consistently, holding through cycles, and treating bitcoin as a long-duration asset rather than a short-term trade.

In a world defined by declining birth rates and permanent economic intervention, owning bitcoin is not about timing markets. It is about positioning capital in an asset that cannot be debased, cannot be bailed out, and does not require population growth to work.

Noteworthy - Gemini posted a blog about DAiM and what it’s like being a large SMA advisor on their platform. Check it out here:

https://www.gemini.com/blog/daims-bryan-courchesne-weighs-in-on-cryptos-evolving-wealth-managementWe have been seeing an increase in new clients coming to us with large positions in self custody requiring estate work. Check out the blog we wrote about what’s going on here: https://www.daim.io/trending-item/why-crypto-holders-with-500k-should-consider-institutional-custody/

Michael Soroudi has earned the CFP® certification, congrats to him. We look forward to adding more value to our clients through expertise in crypto strategies and long-term financial planning. Read more here: https://www.daim.io/trending-item/a-cfp-professional-joins-our-team-to-strengthen-bitcoin-financial-planning

How DAiM benefits clients

Wealth Management: As a licensed Registered Investment Advisor (RIA), we cater to clients with diverse financial needs, including Trust accounts, brokerage accounts, and IRAs. Our services encompass comprehensive tax strategies and audits to optimize your financial outcomes.

New Services:

Financial Planning through institutional-grade tools like eMoney

Estate Planning through our partnered estate attorney

Licensed Tax Guidance through our partnered crypto-focused CPA

Who We Serve

Busy Professionals who want bitcoin exposure without tracking markets full-time

Retirement Investors seeking bitcoin and digital asset exposure inside IRAs

Intergenerational Families focused on long-term wealth transfer, including gifting in bitcoin

Complexity-Constrained Investors managing multiple wallets, platforms, and reporting requirements

Advanced Investors using bitcoin options strategies such as covered calls and collars

Income-Oriented Investors exploring bitcoin lending while retaining asset ownership

Estate and Tax-Conscious Investors navigating custody, reporting, and long-term planning

Enhanced Support and Communication: We understand the frustrations of navigating communication with crypto exchanges. At DAiM, we provide easy access to expert guidance, ensuring seamless communication for our clients.

Curious to Learn More About Investing with DAiM? Contact us at hq@daim.io