DAIM Issue 24 - Don't Wait to Invest in Bitcoin

Welcome to DAIM's Newsletter. DAIM is a licensed Registered Investment Advisor and asset manager for digital assets and Bitcoin 401(k)s. Please enjoy our thoughts below. #Bitcoin #Ethereum

July 4, 2023

Forecast

Big Weeks

ETFs

Long-Term Predictions

Forecast - Mid-month saw a bullish catalyst with the news that multiple Spot Bitcoin ETF applications were being filed. Among them was TradFi giant BlackRock, who had only had 1 of their previous 575 applications rejected. However, on June 30th, a headline came out that the SEC would reject all new spot ETF applications. That negativity was shortlived as Bitcoin barely budged on that news, and remained hovering around $30K. Any ETF approval is likely 240 days or more away, just in time for the next halving. So don’t fret, it may take a few months but it seems like good times are ahead. For July we see Bitcoin trading in a range of $25,000-$33,000

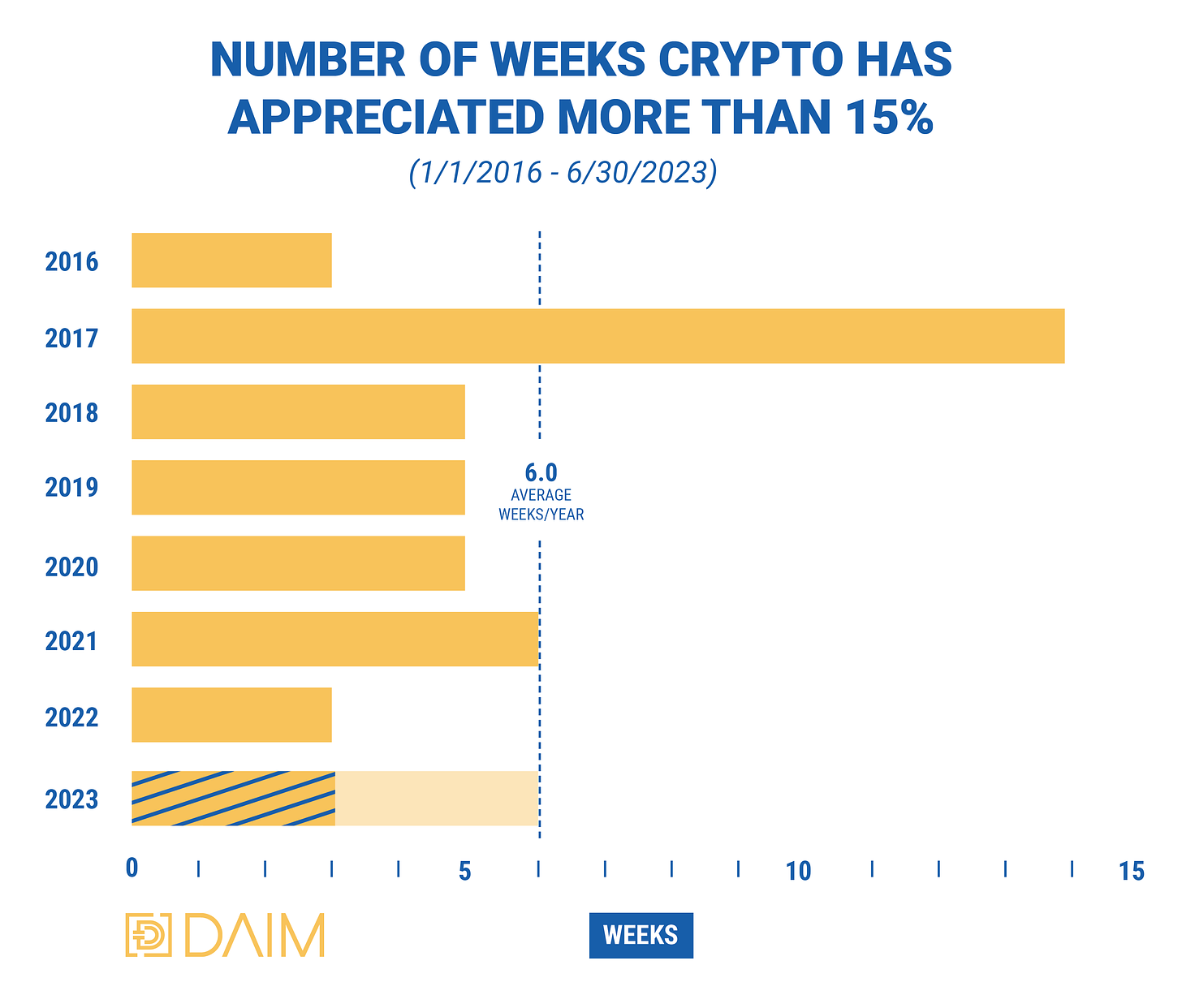

Big Weeks - As we’ve mentioned in the past Bitcoin has the ability to make large positive moves in a short time span. The 15%+ moves are something we have tracked for the last couple of years. Since 2016 Bitcoin has averaged about 6 such weeks per year. This year we’ve had 3 already with the most recent happening the third week of June. Whether we have 3 more to go by the end of the year remains to be seen. What we do know is that despite scrutiny from regulators and overall uncertainty in the market, Bitcoin continues to do what it does and march up like it's in a bull part of the cycle. Even the highest-flying tech stocks can’t match Bitcoin’s outperformance. Tesla, since 2016 has only had 16 such weeks, an average of about 2 per year. And if you’re indexing, the chance of experiencing these moves is even slimmer. The S&P had only one of those weeks in the last 7 years! Ditto for the NASDAQ. While these results obviously can’t be guaranteed, Bitcoin’s proven track record does give us confidence for the future. If you are looking to add Bitcoin to your portfolio now would be a great time.

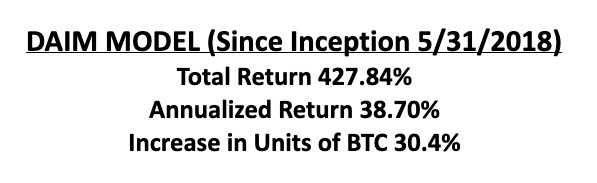

ETFs - It looks like the wait is going to be a little longer for a spot BTC ETF. There was some optimism that Blackrock, and their 575-1 record of approval, would finally get the green light from the SEC. But that hope took a hit this morning when news leaked that the SEC so far has deemed the applications “inadequate”. Whether they become adequate or not remains to be seen. Our feeling is that it shouldn’t matter to retail investors. If you want to invest in Bitcoin you don't have to rely on a futures ETF (BITO) or shares of a Grantor Trust (GBTC). There is a way to get direct exposure to Bitcoin through an entity that is registered with the SEC. We have been helping clients invest directly in Bitcoin and other Digital Assets for 5 years. Not only are we licensed but we conduct stringent due diligence to make sure our partners are licensed and regulated as well. So if you haven’t already, don't wait to get long Bitcoin. As we've shown it only takes a week to generate a meaningful return, a few months could make a big difference.

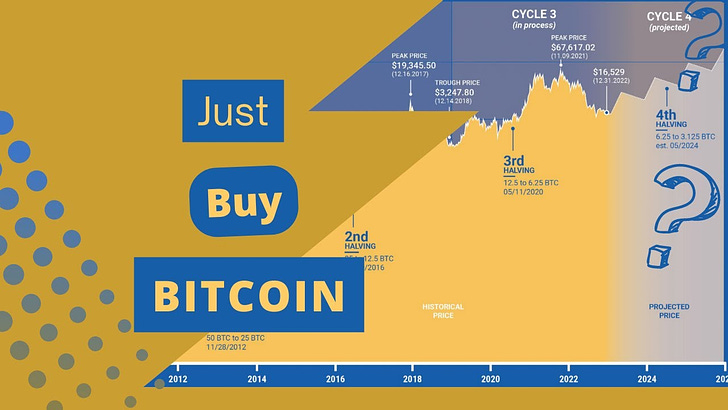

Long-Term Predictions - The future for Bitcoin looks bright in our eyes. We modeled returns through the halving to the end of next year. The model incorporates past halvings and negative catalysts in an attempt to predict where we could get to in the future. For 2023 our model simulations have Bitcoin at an average price of $48,800. We think that a 60% return is conceivable given Bitcoin’s behavior in past cycles leading into a halving. In the real world, we think that a spot Bitcoin ETF will be approved and retail investors who got burned by Celsius, FTX, Genesis, et al. will return and begin allocating capital once again. The fact that so many Asset Managers are applying for a spot ETF indicates that institutional interest is growing. This groundswell of demand will be a major positive catalyst for a fixed-supply asset like Bitcoin. Even if the capital flows into financial instruments that only act as a proxy, it will introduce more people to Bitcoin as an investment. And once those people discover that they can own Bitcoin itself, we think demand will increase as individuals realize they can literally own a piece of the pie. And that available piece will only shrink as time goes on.

In 2024 the next halving will occur. This is where most of Bitcoin’s bull runs really take off. As the mining reward decreases the selling pressure from miners likewise decreases and even a small uptick in demand can push prices much higher. We’ve had 3 halvings and 3 massive runs in price succeeding those halvings. We don’t think the 4th halving will be any different. Our model simulations predict an average end-of-2024 price of $130,500. We think that the investors that can allocate to Bitcoin sooner rather than later will be rewarded.