DAIM Issue 34

Welcome to DAIM's Newsletter. DAIM is a licensed Registered Investment Advisor and asset manager for digital assets and bitcoin 401(k)s. Please enjoy our thoughts below. #Bitcoin #Ethereum #Solana

Forecast

Big Weeks Ahead

Cycles Chart

Restaking

Whales Feeding

Forecast - As we predicted, the actual halving would not be an event that moved the needle price-wise. Bitcoin stayed more or less flat in the lead-up and subsequent weeks after the halving. We think that at some point, there will be catalysts that will increase the demand. Whether that happens in May or later this summer is to be seen. Once we do get that event, the lack of newly minted bitcoin to add to the supply will start to affect the price. We think the demand will most likely come from Tradfi buying spot ETF products and could be from companies like Vanguard warming up to the idea of Bitcoin. For May, we think 55k-75k is the range, with an outside chance of testing 80k.

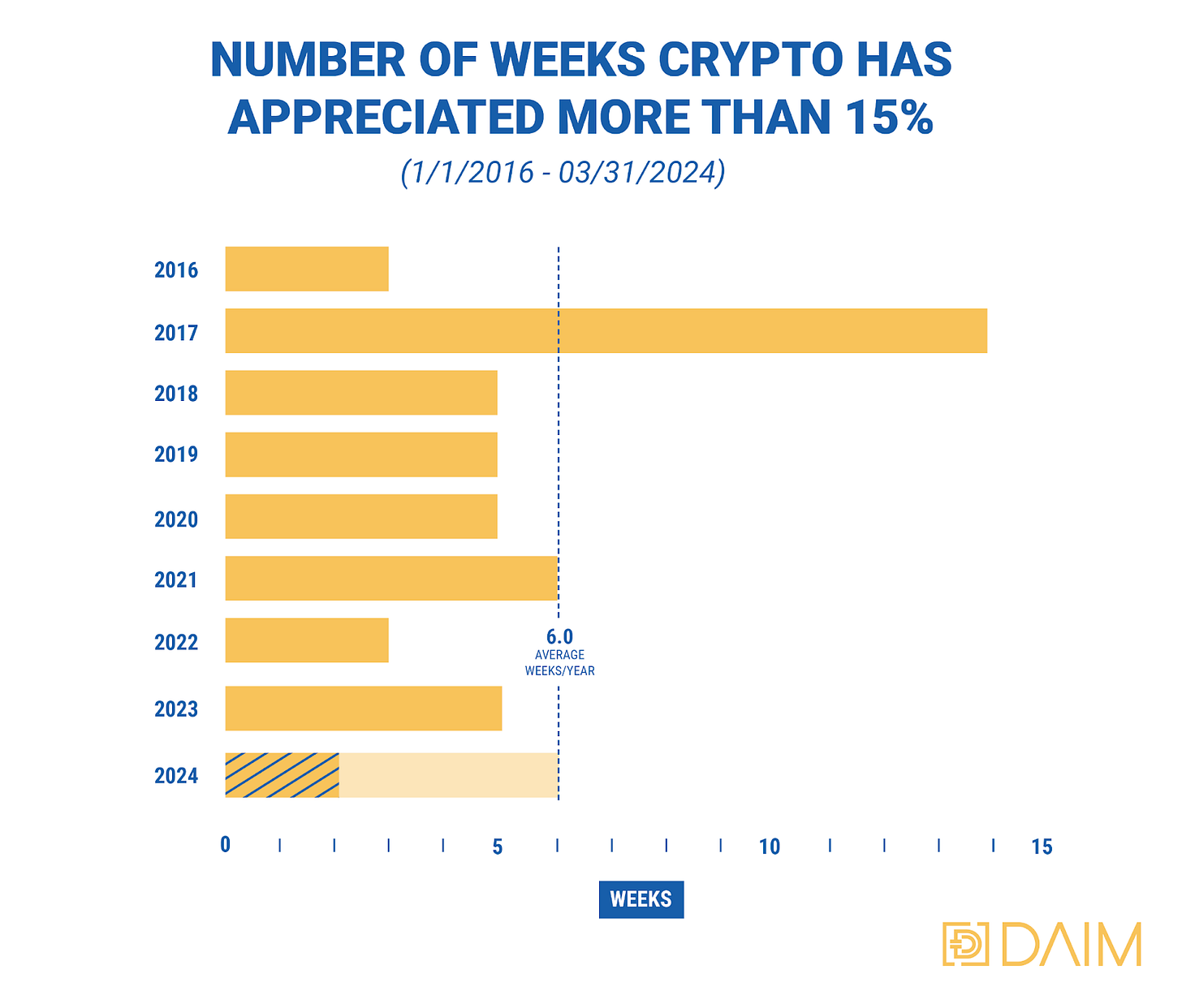

Big Weeks Ahead - Our favorite metric is back! In Q1, bitcoin experienced two 15%+ weeks. That would put bitcoin on pace for eight such weeks in 2024. That is above our 5-year average of six weeks per year but normal for what bitcoin has experienced during the bull part of the halving cycles. If you’re thinking about putting money to work in digital assets, history has shown that now is a great time to get positioned. The 12 months following the halving tend to be when crypto investors experience the best returns. We still believe that $130k bitcoin by year-end is possible, and there will be multiple 15%+ weeks before now and then. While there will be volatility, those with a long investing time horizon (5-10 years) would be better off not trying to time an entrance and just buying as soon as possible. The more of these 15%+ weeks that you can capture as an investor, the more your investment will compound and the more your money will work for you. It’s a great way to set yourself up for future success.

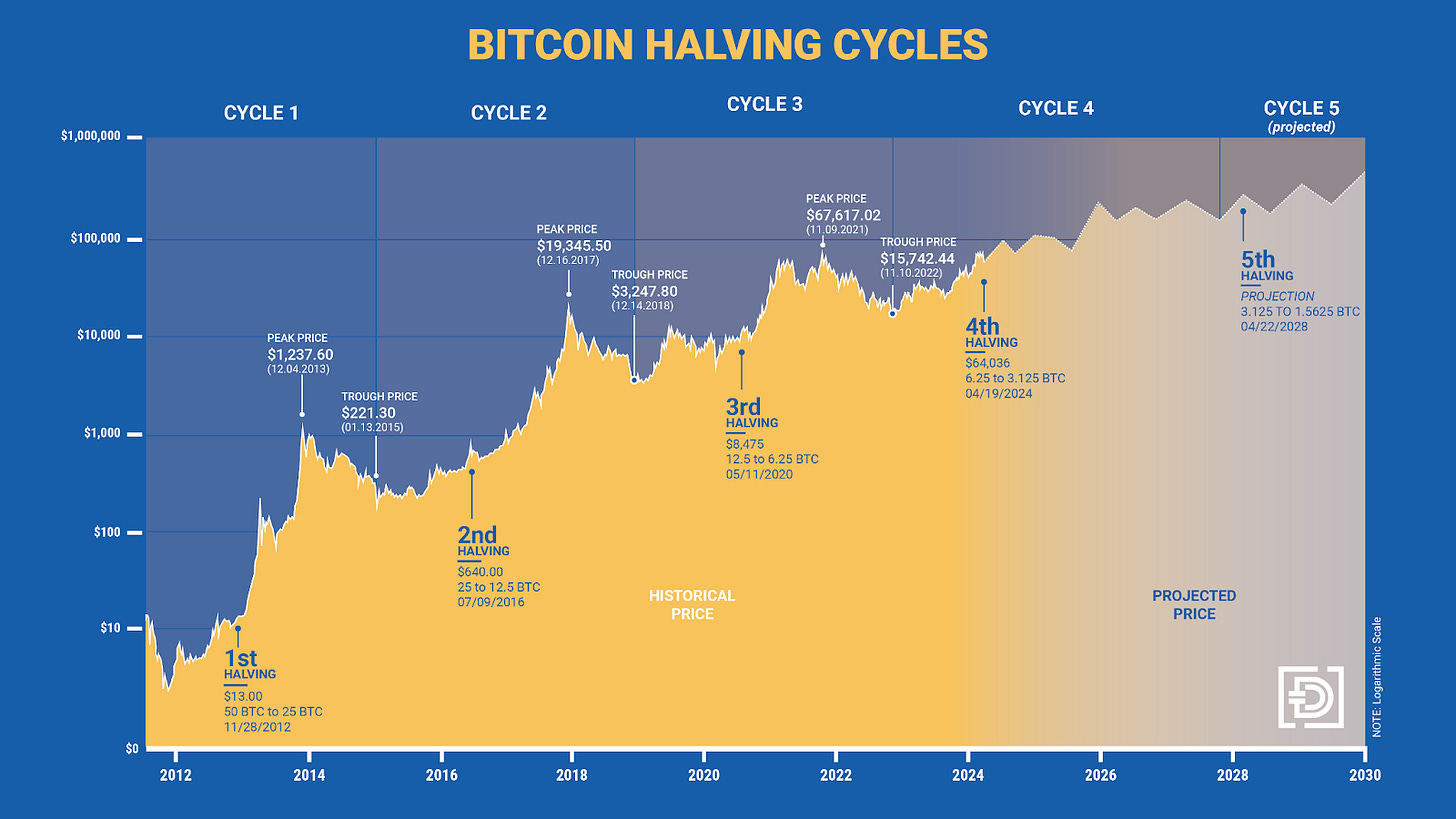

Cycles Chart - Another chart that should look familiar to clients and readers is our Bitcoin cycles chart, which shows the peaks and troughs and all the halvings in bitcoin’s history. We recently updated it to include the latest halving and the projected price through the next halving into 2030. It’s interesting how the bitcoin price has performed over the last 10+ years. While the volatility is still present, it seems to be declining over time. The latest peak-to-trough drawdown was the smallest. You’ll also notice that bitcoin, despite its ups and downs, has continued to march on up and to the right. This means that investors will be rewarded with an appreciating asset over long holding periods. We don’t know what the future holds. However, we do think bitcoin, with a scarce supply of only 21 million coins, will be able to attract new users and investors. That increase in demand, coupled with its limited supply, should continue to push the price up over time. We think that by 2030, the price of one bitcoin could very easily reach $400,000 - $500,000.

Restaking - By now, you should be familiar with the concept of staking with ETH. To refresh, staking involves committing your ETH holdings to a validator. Validators are responsible for validating transactions and securing the network. Those validators are rewarded with ETH for performing the service of validating. The more validators there are the more decentralized and secure the network is. However, this security does not extend to layer 2 protocols. Enter restaking. Restaking is the process of creating a “token” out of staked ETH that can then be used to stake again on layer 2 protocols. Proof of stake relies on users committing their holdings to secure the network, and since Ethereum is a large and decentralized network, this protocol works well. But lesser-used protocols still need security, too. The ability of a network to grow and thrive is dependent on its security from attacks. Bootstrapping staked ETH to be reused on layer 2 protocols allows this security to be reused and, therefore, creates a safer and more robust ecosystem. From an investor standpoint, the ability to restake ETH generates additional yield, enhancing the total return of holding Ethereum. Keep in mind that generating additional yield through restaking does introduce additional risk. Since the idea is relatively new, we don’t know if and to what extent an exploit could affect those who choose to re-stake. The leading restaking protocol is Eigenlayer, allowing solo stakers and those holding Liquid Staking Tokens, like STETH & RETH, to restake their holdings. Restaking is a new and exciting development to keep an eye on, but we don’t recommend restaking your holdings until the protocol becomes more tested.

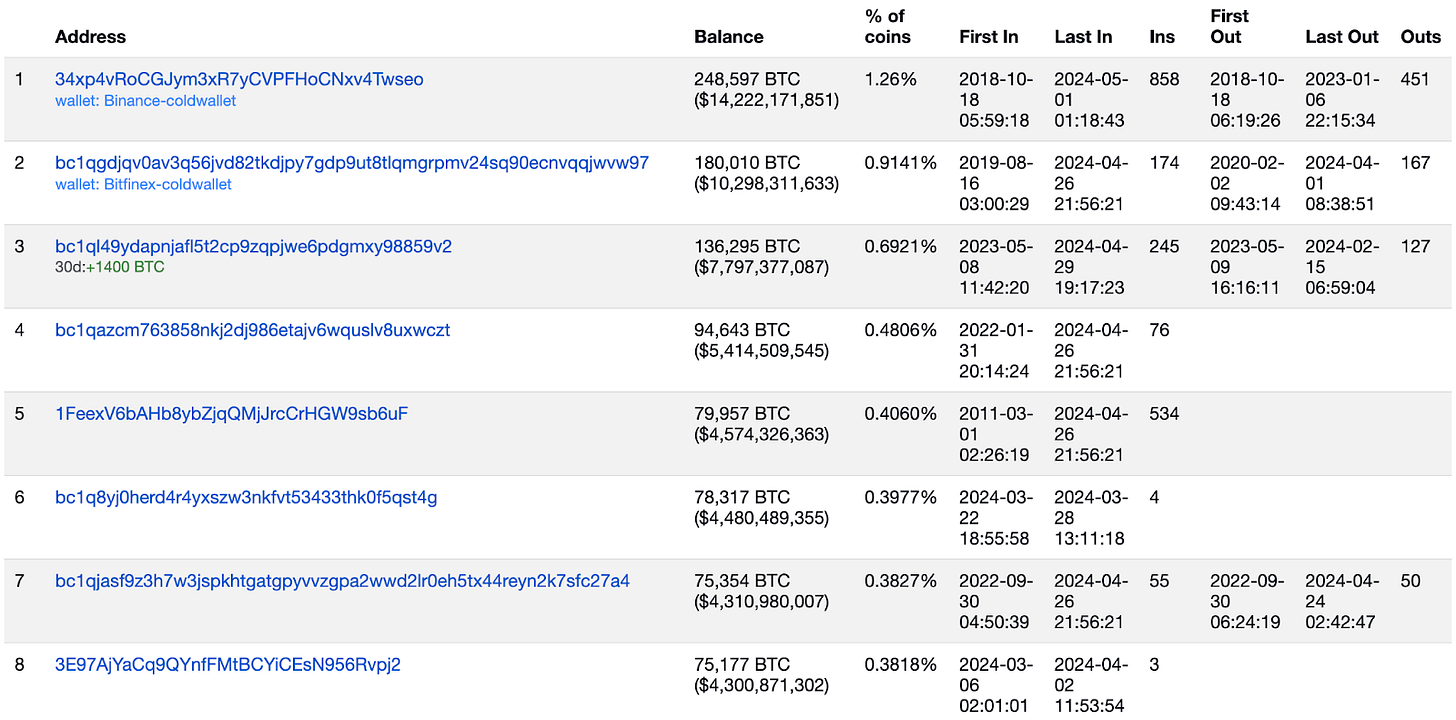

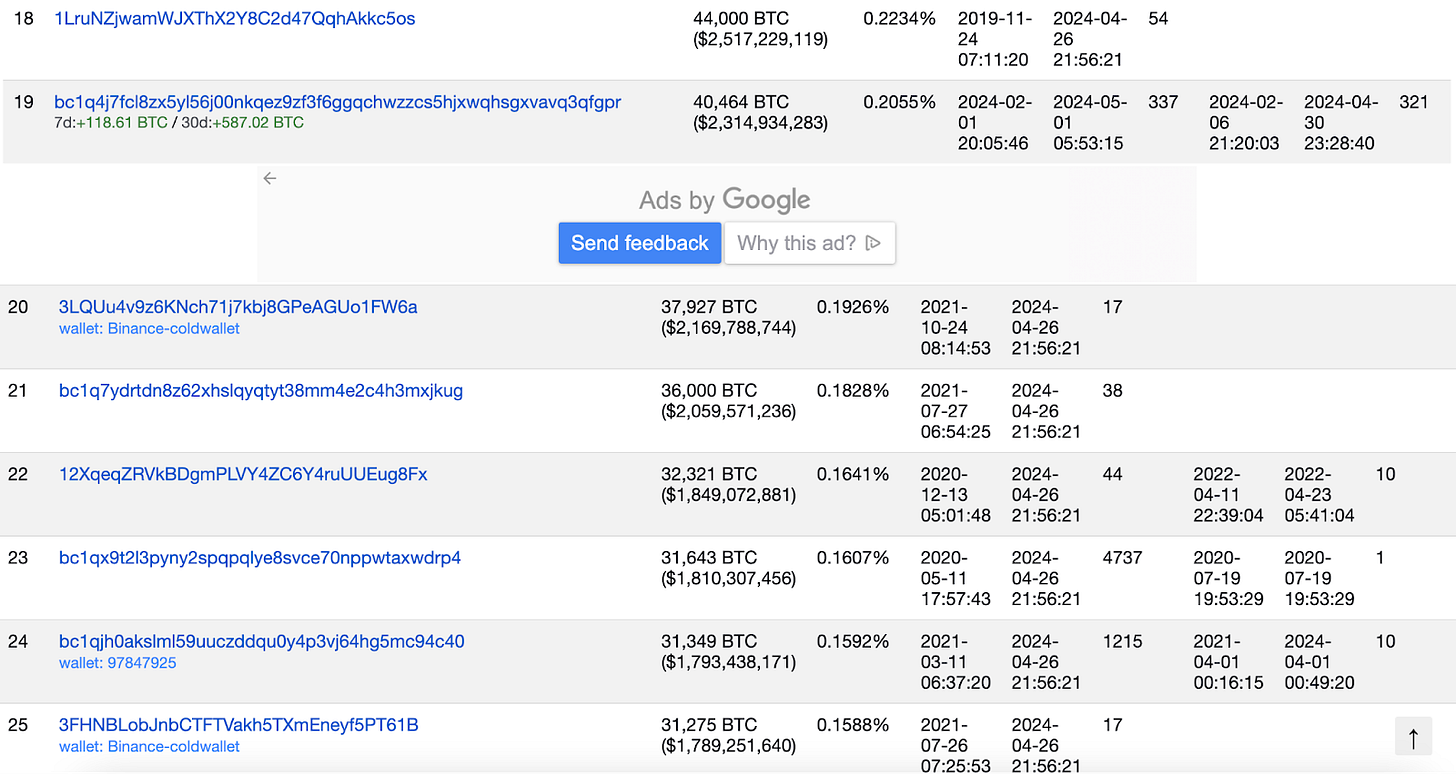

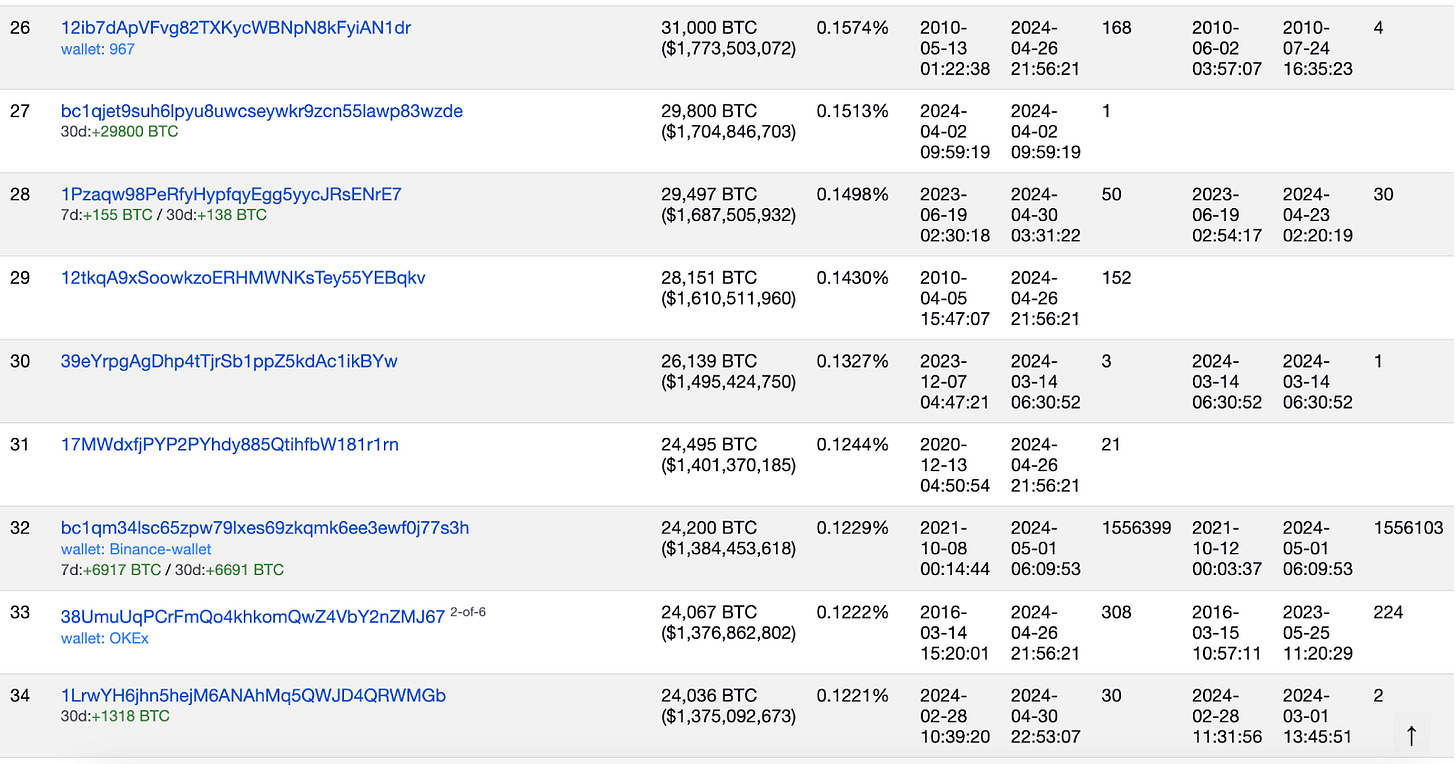

Whales Feeding - Bitcoin is up more than 30% to start 2024 due to Tradfi and spot bitcoin ETFs. You couldn’t blame Hodlers if they took profit here and locked in some gains. Is legacy finance providing exit liquidity for hodlers? It doesn’t appear so. Go through bitcoin’s rich list. As you click through the addresses, you’ll notice that in the last 30 days, the majority have actually added bitcoin! Many of these large wallets belong to exchanges, and BTC inflows aren’t necessarily positive. Still, if you scroll down the list, you will see the majority of the top 100 added, and most of those addresses do not belong to centralized exchanges. We think this is further evidence that we are still in the accumulation phase of the bull cycle. The 12-18 months following halvings are generally when the most alpha has been generated from holding bitcoin and digital assets. We expect these addresses to continue to add at least through the end of the year.