DAiM Issue 51

Welcome to DAiM's Newsletter. DAiM is a Registered Investment Advisor and award winning crypto asset manager. Please enjoy our thoughts below.

“No asset has a mass movement or revolution backing it” - Eric Yakes on Bitcoin’s path to $10,000,000.

Patience is Key

Staying Ahead

DATs

Patience is Key - Investing in bitcoin can feel exhilarating, but also nerve-wracking. Once you’ve decided to invest, the next hardest part isn’t buying at the right price. It’s something much more challenging: being patient.

This bull market could last for years, not just months. In fact, it’s possible it could span an entire presidential term. That’s a long journey, and it won’t be a straight line.

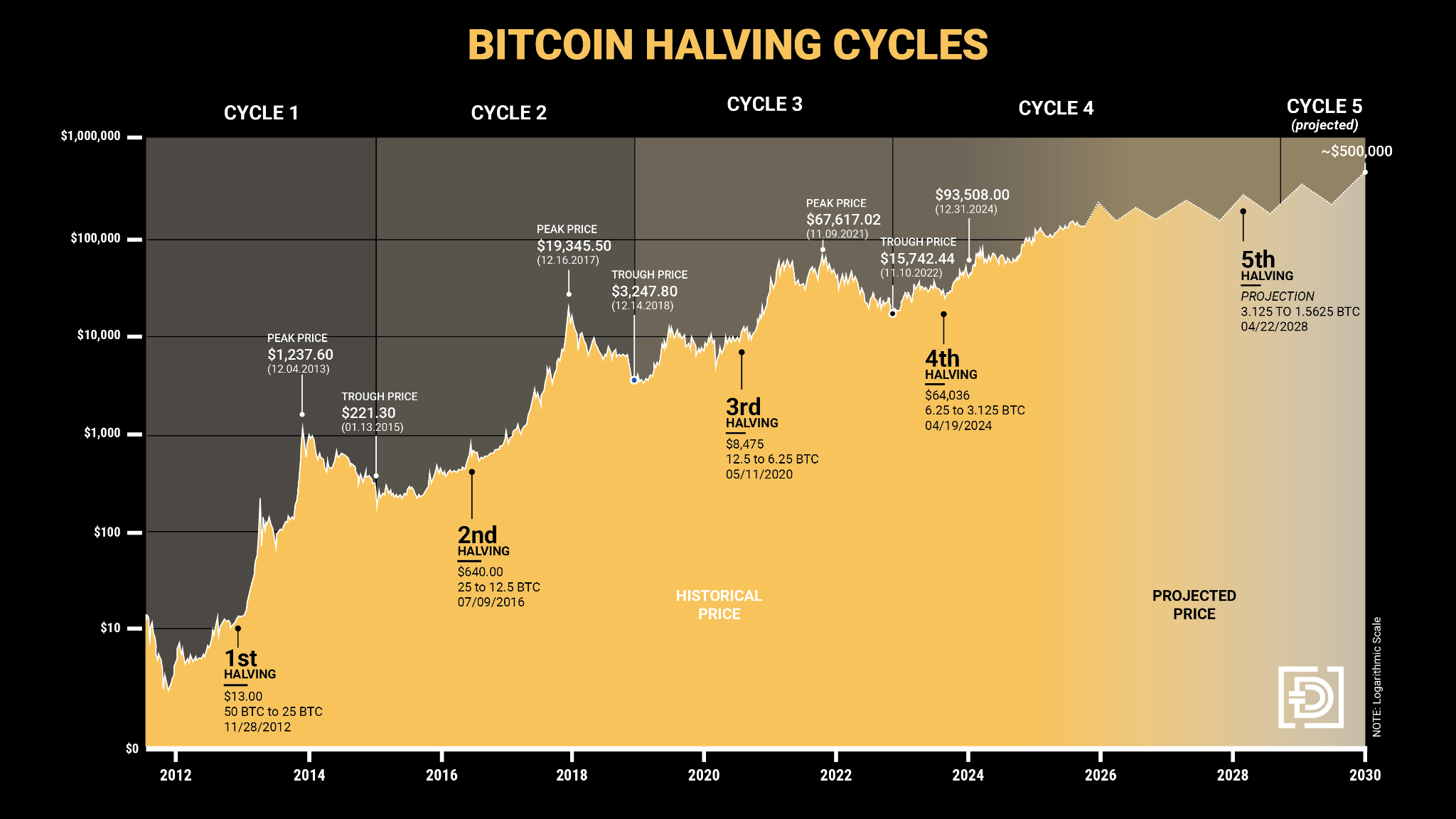

History reminds us that bull markets are rarely smooth. Between 2015 and 2017, bitcoin experienced around eight drawdowns of 30–40%. So far in this cycle, we’ve only seen two, which suggests more pullbacks could still occur. These moments can feel unsettling, but they are a normal part of the market’s rhythm.

Patience is also about enduring stretches of “boring” markets. Bitcoin often moves sideways for months, giving the impression that nothing is happening. Then, almost suddenly, it can soar in a very short period, sometimes two weeks, capturing the gains of the entire year. This delay in the euphoria phase is nature’s way of testing investor conviction.

For long-term investors, the message is clear: volatility is part of the journey, but it doesn’t define it. Staying disciplined through pullbacks, ignoring the noise, and maintaining focus on your long-term goals is the most effective strategy.

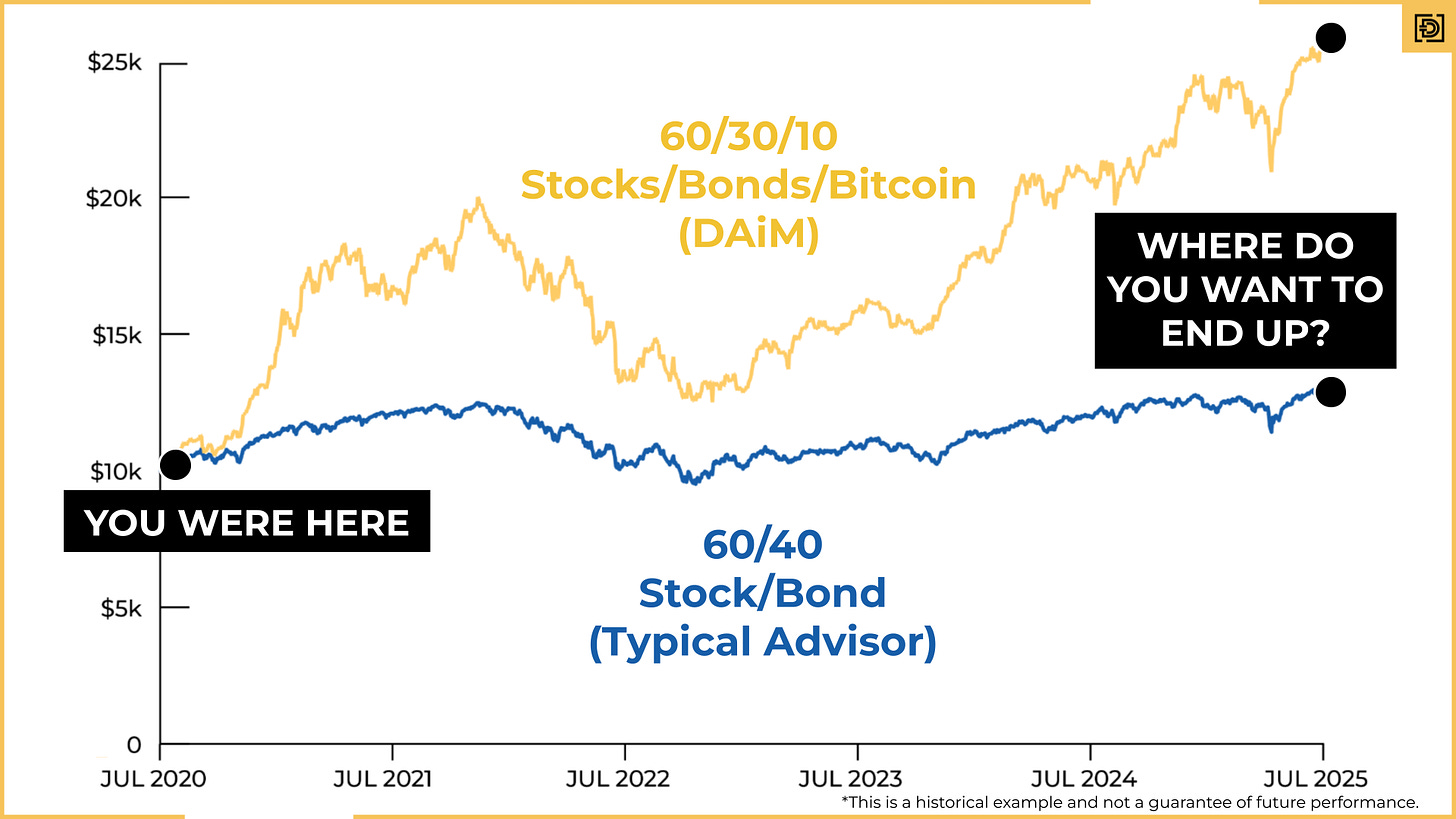

The next few years could include more head fakes, periods of stagnation, and sharp drawdowns, but they could also offer significant upside for those willing to remain patient. Our forecast has Bitcoin reaching $500,000 in 2030. This shows that in the world of bitcoin investing, time in the market matters far more than timing the market.Staying Ahead - For decades, the traditional 60/40 portfolio, 60% stocks, 40% bonds, was considered the gold standard for retirement investing. It balanced growth with stability, offering both upside and protection. But more and more investors are realizing that this formula may no longer be enough to sustain them in retirement.

We’ve seen it firsthand with prospects and clients: there’s a growing discomfort that the 60/40 portfolio won’t provide the security it once promised. If inflation runs hotter than the modest levels of the past, bonds may not protect purchasing power, and stocks may not keep up. Retirements are lasting longer, which means portfolios need to work harder for longer. Bonds no longer offer the same income they once did, while equities come with their own risks in an increasingly unstable world. Protecting principal alone isn’t enough anymore. Investors need growth.

This realization is pushing many to explore portfolios that lean more heavily toward growth. Traditionally, that meant allocating more to equities. But equities are still tied to the same economic system that’s under pressure from debt, inflation, and political uncertainty. That’s where bitcoin enters the picture.

Bitcoin offers something unique. With a fixed supply, it isn’t subject to debasement like fiat currencies. Its long-term growth profile has looked more like a high-growth index than a bond, offering diversification that goes beyond traditional markets. And as investor preferences evolve, we’re seeing a gradual but steady move from conventional asset mixes toward portfolios that allocate meaningfully to bitcoin.

For older investors, this doesn’t mean abandoning stability altogether. It means recognizing that stability without growth won’t provide for a 20–30 year retirement. By thoughtfully incorporating bitcoin into a portfolio, investors can protect against the risks of currency debasement while positioning themselves for meaningful upside.

The 60/40 portfolio defined investing for the last generation. The next generation of retirees may need something different, something that blends traditional income assets with higher-growth opportunities like bitcoin. Protecting principal is no longer enough; protecting purchasing power requires growth. And bitcoin has an increasingly important role to play in that equation.

We’re at the beginning of a shift in portfolio construction—one driven by the first generation of investors to seriously integrate crypto assets like bitcoin. What the future mix looks like, whether it’s 60/30/10, 65/20/15, or something else entirely, remains to be seen. But one thing is clear: it will require thoughtful collaboration between financial planners, risk managers, and compliance professionals. As investor needs evolve, the wealth management industry must adapt, embracing new tools and strategies to meet the challenges of longer retirements, persistent inflation, and a rapidly changing economic landscape.

DATs - It was just a few months ago when we first wrote about companies following in Microstrategy’s footsteps with Bitcoin Treasury strategies. Since then, the trend has grown quickly, not only in the number of companies experimenting with it, but also in the types of assets being adopted. The pace of change is remarkable, but it is also attracting scrutiny from regulators like the SEC and FINRA. That scrutiny could turn many of today’s bold experiments into tomorrow’s cautionary tales.

Below is a quick glance at some of the strategies companies unveiled over the summer:

June: BitMine Immersion (BMNR) announced a $250 million private investment in public equity (PIPE) to fund Ethereum purchases. The company now holds around 2.4 million ETH (more than $9 billion).

July: Justin Sun made headlines with a Tron initiative through Tron Inc. (TRON), a reverse merger with SRM Entertainment that rebranded and added roughly 365 TRX tokens to its balance sheet.

August: Faraday Future (FFAI) introduced one of the more ambitious Digital Asset Treasury plans at that point. Its treasury is anchored by the C10 Index, a basket of the top 10 cryptocurrencies (excluding stablecoins), with an allocation designed to earn 3–5% staking yields. The company has committed between $500 million and $1 billion, with $30 million already deployed.

September: Two companies went even further by buying, staking, and participating in token governance. Forward Industries (FORD) committed $1.65 billion of its treasury to Solana tokens and signaled an intention to stake and potentially validate transactions. Hyperion DeFi (HYPD) accumulated over 1.7 million HYPE tokens not just to hold, but to actively stake and participate in governance within the Hyperliquid ecosystem. And, in a unique turn of events, M&A activity has begun in this sector, with one DAT acquiring another. This trend is likely to accelerate.

While these strategies reflect growing confidence in alternative blockchains, they also expose companies to higher levels of volatility, technical risk, and regulatory uncertainty. We may be getting more regulatory clarity soon, and it might not go in the direction crypto proponents want. US regulators are investigating suspicious stock trading surrounding these treasury announcements. FINRA and the SEC are reportedly reaching out to a handful of the roughly 200 DAT companies. The main issue: front-running announcements by buying stock before the public knew about the treasury play.

Material non-public information is something no investor should be able to act on. If insiders bought shares, or shared knowledge of the announcement with others who did, those investments would have been made illegally. Fair disclosures are paramount to maintaining the integrity of capital markets. It’s an important development to monitor. If front-running is rampant, it would be a black eye for the crypto space.

We’re also seeing the market value of digital asset treasuries, particularly marked Net Asset Value (mNAV), come under scrutiny as a reliable metric. Combined with the regulatory concerns around insider trading and disclosure, these developments are likely to slow the pace of new DATs being formed. But one point remains clear: these companies are buying pure crypto assets. If they believe these assets will be the most valuable over time, that’s a strong signal for individual investors. Rather than just gaining exposure through equities, holding the underlying crypto directly may be the smarter long-term move.

How DAiM benefits clients

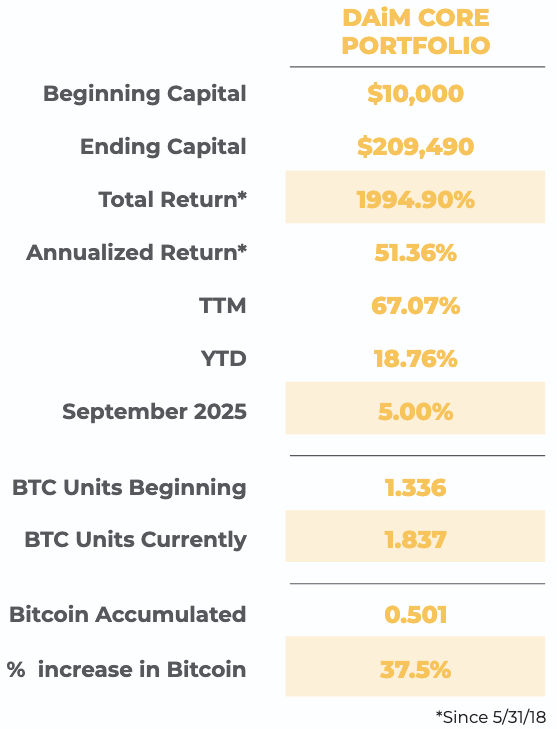

Model Portfolio: Our meticulously managed portfolio has consistently outperformed the simple strategy of buying and holding bitcoin alone by more than 571% since inception on 5/31/2018.

Wealth Management: As a licensed Registered Investment Advisor (RIA), we cater to clients with diverse financial needs, including Trust accounts, brokerage accounts, and IRAs. Our services encompass comprehensive tax strategies and audits to optimize your financial outcomes.

Tailored Solutions for Various Investors:

Individual Professionals: Busy individuals like doctors who lack the time to stay updated on market trends.

Altcoin Exposure in Retirement: Investors seeking exposure to alternative coins within their retirement accounts.

Intergenerational Wealth Planning: Large families aiming to create and manage intergenerational wealth, including gifting in bitcoin across multiple generations.

Simplified Management: Investors overwhelmed by the complexities of managing multiple wallets and decentralized exchanges (DEXes), finding it challenging to track or rebalance their assets promptly.

Bitcoin Options Trading: Investors looking to manage risk or generate additional yield through advanced strategies like bitcoin covered calls and zero-cost collars.

Bitcoin Lending: Investors seeking opportunities to lend their bitcoin and earn interest while retaining ownership of their assets.

Enhanced Support and Communication: We understand the frustrations of navigating communication with crypto exchanges. At DAiM, we provide easy access to expert guidance, ensuring seamless communication for our clients.

Curious to Learn More About Investing with DAiM? Contact us at hq@daim.io